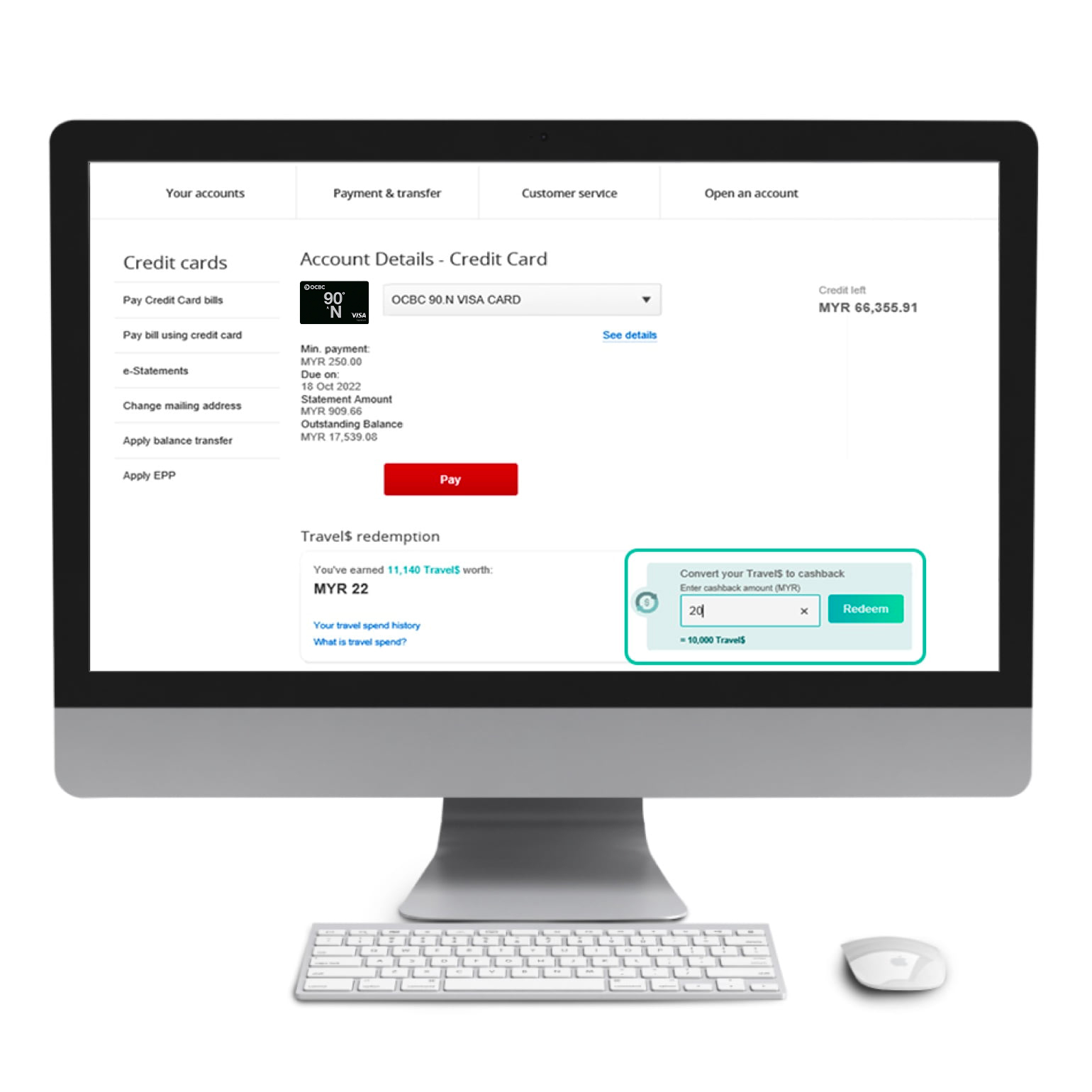

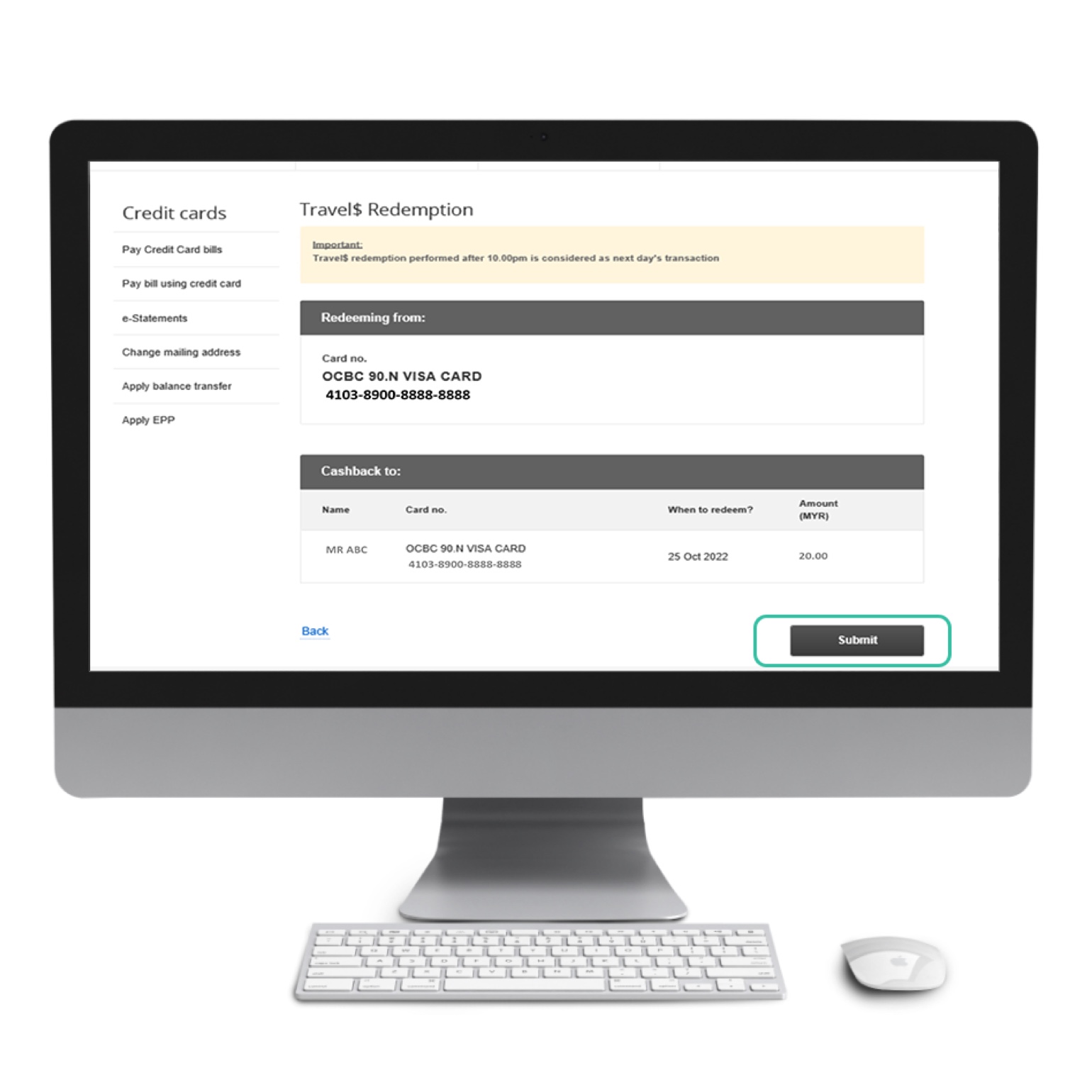

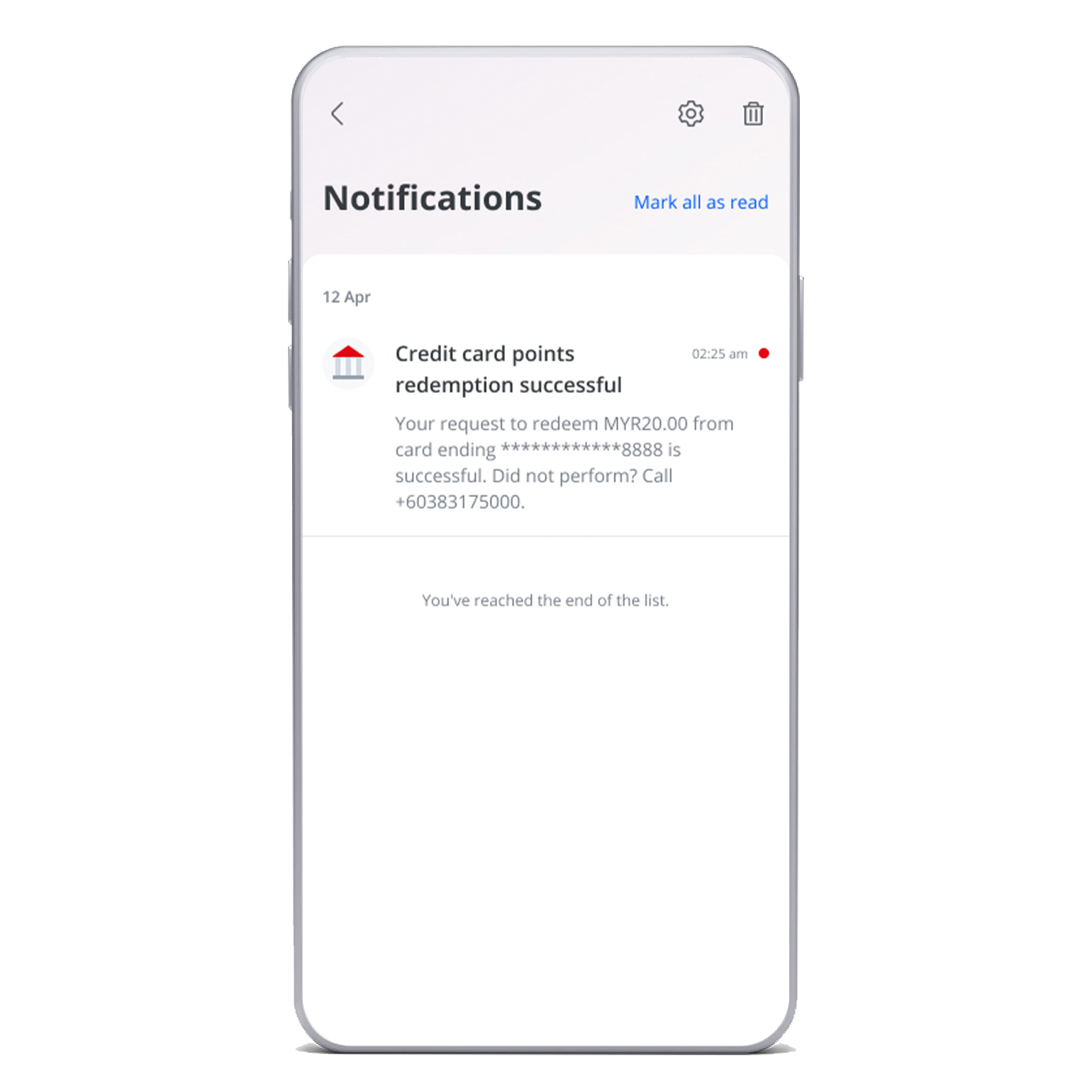

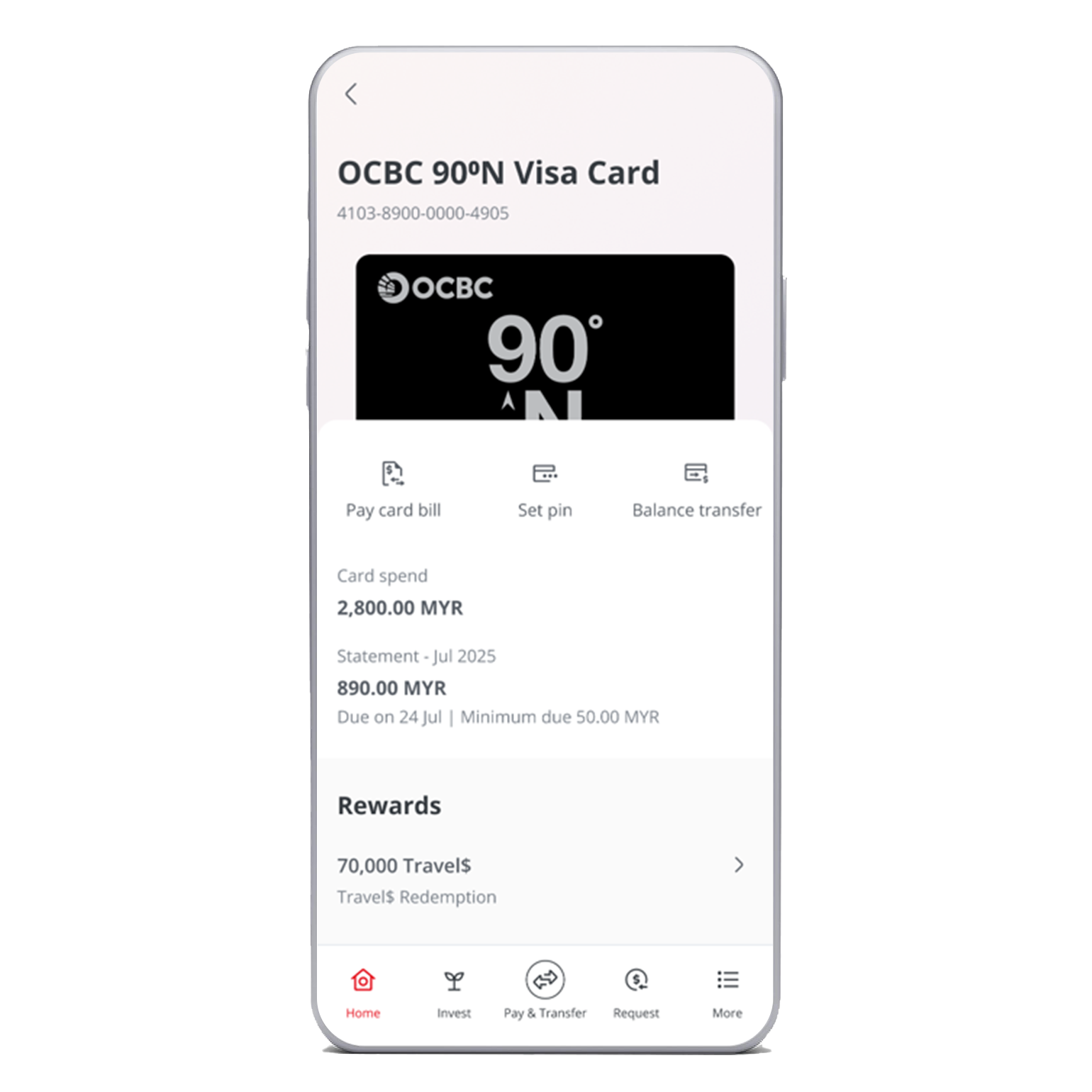

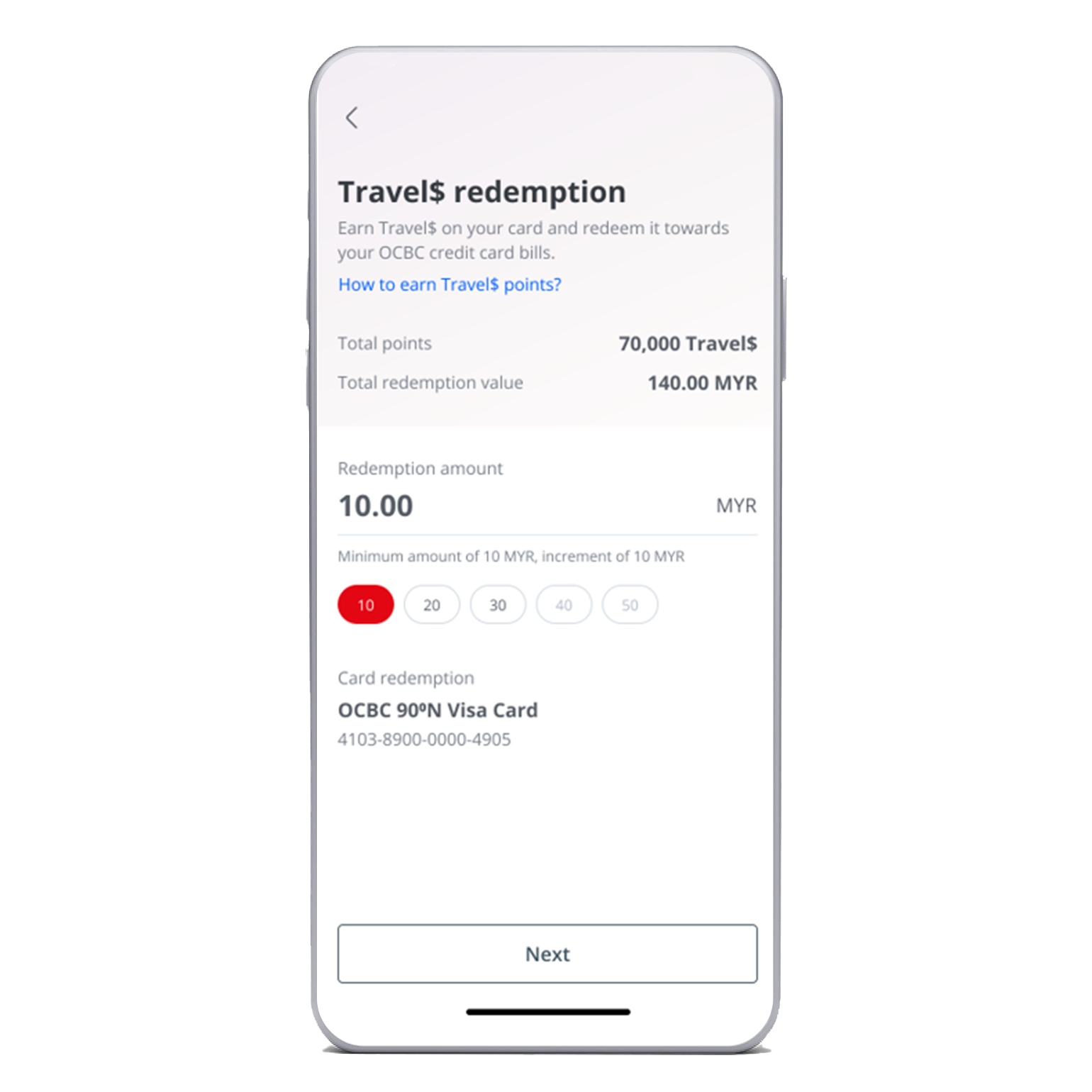

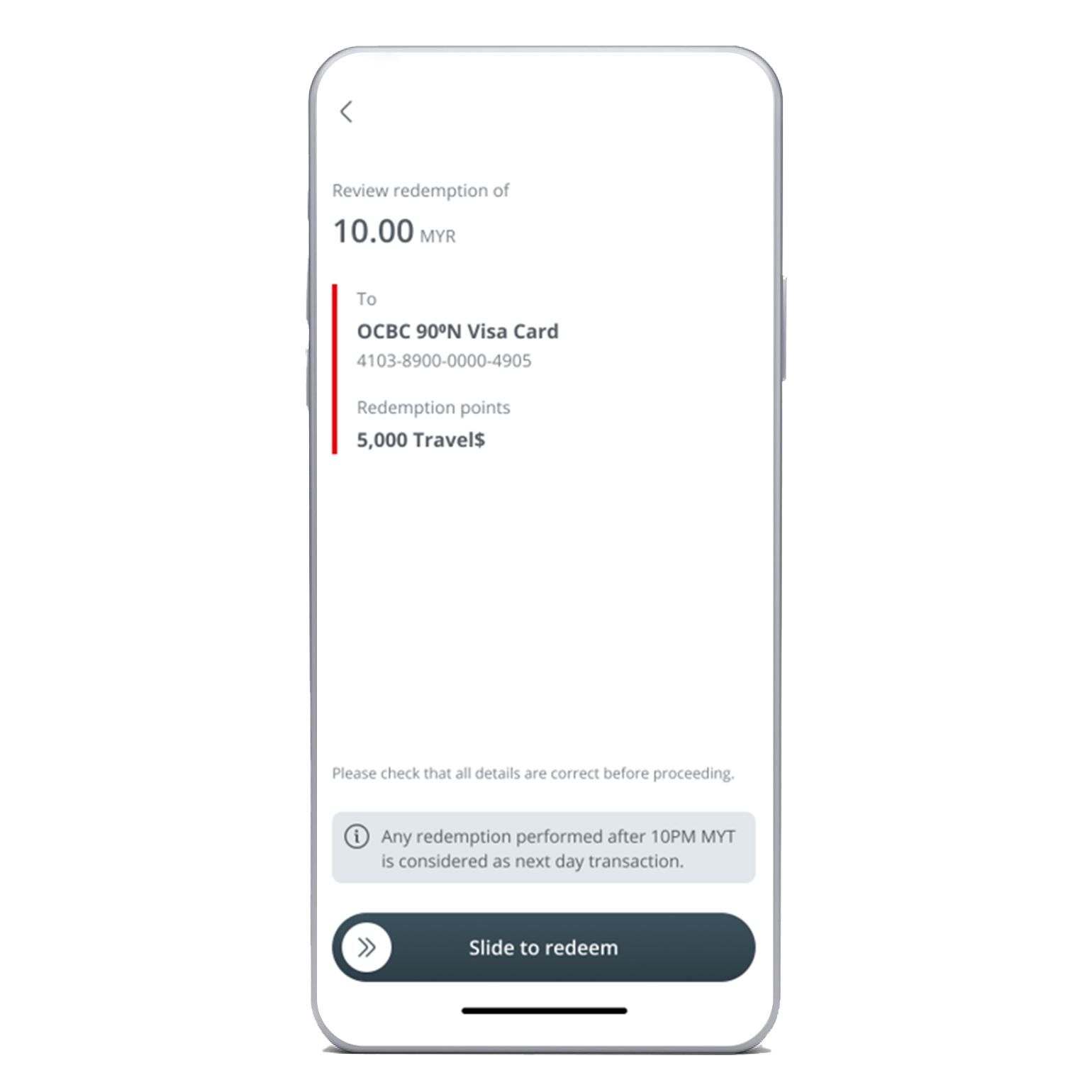

You can earn Points (“Travel$”) on purchases legitimately charged to your OCBC 90⁰N Visa Card as shown in the table below. Each OCBC 90⁰N Visa Card transaction amount will be rounded down to the nearest Ringgit Malaysia or Ringgit Malaysia equivalent for purposes of computing the total number of Travel$ eligible for the transaction.

Table 1

| Amount charged to the OCBC 90⁰N Visa Card | Travel$ |

| Every RM1 for Total Retail Spending done locally | 1 |

| Every RM1 equivalent in foreign currency for Total Retail Spending done overseas OR online transactions made in currency other than Ringgit Malaysia | 5 |

Note: The Travel$ will be awarded upon settlement of the purchases made.