Auto Balance Conversion is a credit card programme available to eligible cardmembers to automatically convert their outstanding balances into smaller instalments if the eligibility criteria are met. If your outstanding statement balance meets a minimum required amount of RM1,000, it will be converted into an instalment plan at 13% per annum for 36 months. You may choose to opt-out of this programme at any time.

OCBC AUTO BALANCE CONVERSION

Faster debt repayment, for greater life enjoyment

Take control of your finances and pay off outstanding credit card balances in a shorter period, at a lower rate.

Lower rate

13% per annum versus 15% per annum to 18% per annum credit card interest.

13% per annum versus 15% per annum to 18% per annum credit card interest.

Hassel-free conversion

Your outstanding statement balances will be converted upon meeting the eligibility criteria (annual assessment).

Your outstanding statement balances will be converted upon meeting the eligibility criteria (annual assessment).

No processing fee

There will be no processing fee charged on the conversion.

There will be no processing fee charged on the conversion.

No termination fee

Flexibility to settle your instalment plan early with no additional fee.

Flexibility to settle your instalment plan early with no additional fee.

Flexibility to opt-out

You can choose to opt-out from each conversion offer.

You can choose to opt-out from each conversion offer.

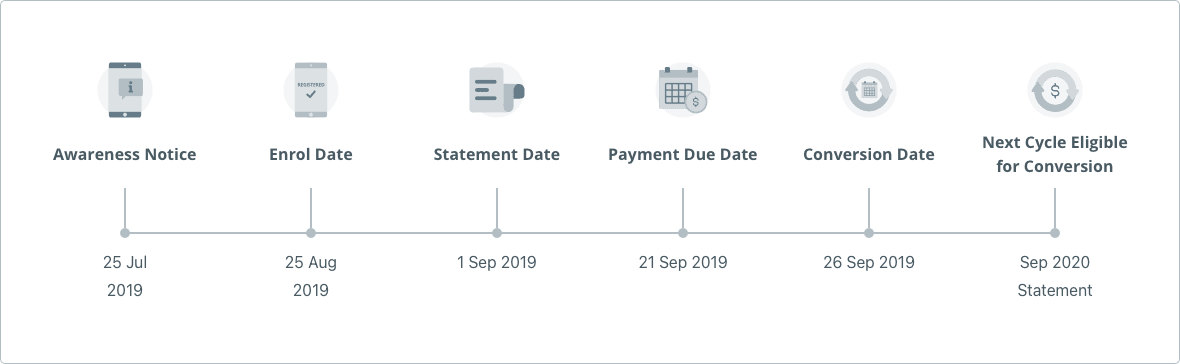

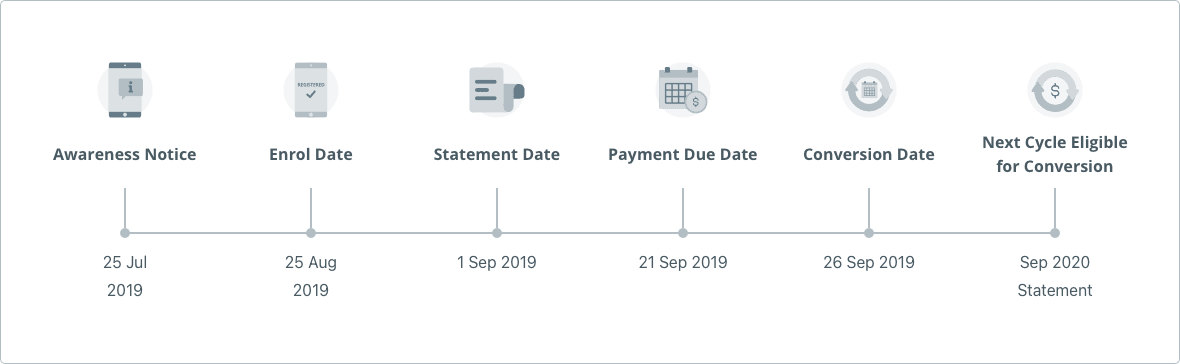

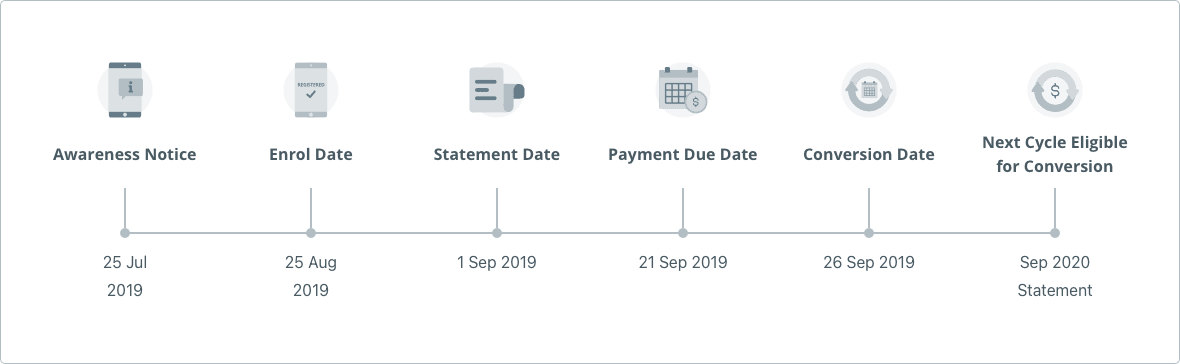

Upon enrolment for this programme, your credit card outstanding balance will be assessed after the payment due date and converted into 36 monthly instalments upon meeting the eligibility criteria every 12 months.

The dates above denote the timeline of how the process works based on the following:

- OCBC Bank will auto-enrol eligible customers

- Upon enrolment, the outstanding statement balance will be converted after payment due date + payment grace period*

* The illustration assumes the payment grace period is 4 days.

Auto Balance Conversion Interest Rate (13% per annum)

|

|

No Auto Balance Conversion Interest Rate (17% per annum)

|

|

Notes:

This is only an illustration of minimum payment due with and without the Auto Balance Conversion with the following assumptions:

- The minimum payment due is 5% of the statement balance. The customer makes the minimum payment due (5%) on a monthly basis.

- There is no new retail spending or cash advance following the conversion.

- The outstanding balance consists of retail spending only and revolves at 17% per annum (interest rate without Auto Balance Conversion).

- The monthly instalment amount from Auto Balance Conversion is RM320 and 100% of the instalment amount is to be paid in full as part of the minimum payment due.

Eligibility criteria

Nationality

Malaysian

Monthly income

Less than or equal to RM5,000 (note that this refers to the latest verified income per the bank's records)

Payment history

Payment ratio less than or equal to 10% (12 previous months average)

Payment ratio calculation

Payment ratio = Total payment / total statement balance (12 previous months)

Account status

Your credit card accounts is current and not past due

Notes

- You will not qualify for future Auto Balance Conversion if your monthly income is above RM5,000.

- You will continue to pay down any outstanding instalments from earlier converted balances.

- Is it important that you inform OCBC of any change in your recent monthly income for the bank to update your details. Please contact OCBC Contact Centre at +603 8317 5000 to inform of your latest monthly income details.

How to opt-out or cancel

- You may opt-out from the Auto Balance Conversion by contacting OCBC Contact Centre.

- Upon opt-out, the bank will not convert your credit card balance to an instalment plan at that point in time. The bank will inform you of the next balance conversion offer 12 months later if you meet the eligible criteria.

- Upon conversion of your credit card balance, you are allowed to cancel within 30 days from the date of conversion without incurring any termination fee. This cooling-off period only applies to first time conversion.

- If you opt to cancel the instalment plan during the 3-year tenure, you will have to pay the outstanding principal in full.

Common questions

The benefits of Auto Balance Conversion are:

- Lower effective interest rate of 13% per annum versus the existing 15% per annum to 18% per annum on your credit card

- Hassel-free conversion - your outstanding statement balances will be automatically converted to 36 months upon meeting the eligibility criteria (annual assessment)

- No processing fee

- No early termination fee - flexibility to settle your instalment plan early

- Flexibility to opt-out from future conversions

You are eligible for the Auto Balance Conversion upon meeting the following eligibility criteria:

- Malaysian

- Monthly income = < RM5,000 or annual income = < RM60,000 (per your income record with OCBC);

- Did not make full payment on credit card outstanding balances over the past 12 months

- Have made an average repayment of = < 10% of credit card outstanding balances in the past 12 months.

Eligibility will be assessed annually.

You will be automatically enrolled into the programme upon meeting the eligibility criteria every 12 months.