- How different is the OCBC 360 Account/-i from other savings account?

The OCBC 360 Account/-i is a savings account that pays you bonus interest/profit when you do all or any of these:

- Deposit at least RM500 every month

- Pay at least 3 bills online every month

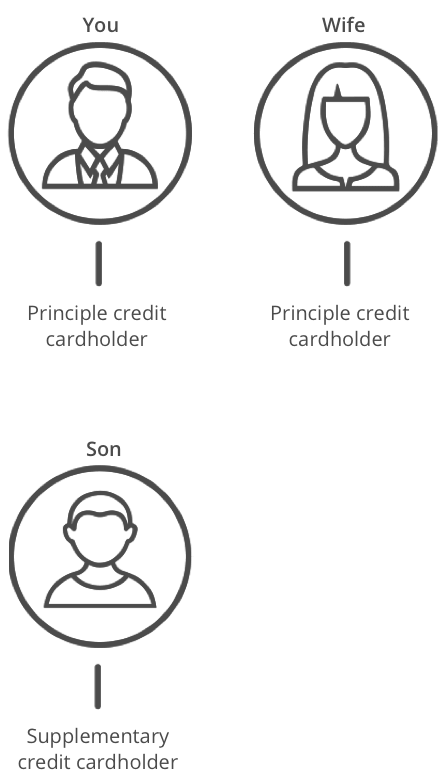

- Spend at least RM500 on your OCBC Debit/Credit card(s) every month

- How is the interest/profit calculated?

You get 2 types of interest/profit on your account balance every month.

- Base Interest/Profit: This interest/profit is accrued daily based on your account's day-end balance and you will receive this at the end of the month.

- Bonus Interest/Profit: This interest/profit is based on the first RM100,000 of your account's average daily balance for that calendar month when you fulfil all necessary requirements for "Deposit", "Pay" and "Spend" pillars. You will receive by the 14th business day of the next month; truncated to 2 decimal places. Business day is a day that is not a public holiday in Kuala Lumpur or Saturday or Sunday.

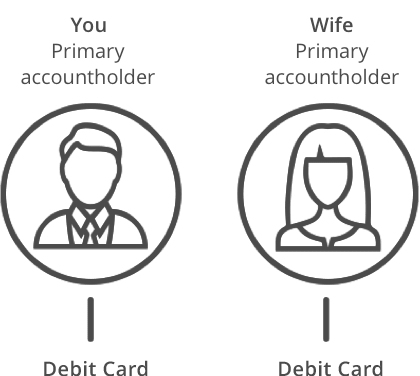

- Can I open more than one OCBC 360 Account/-i?

No, you may only open one account where you are the Primary Account holder. This means that if you already have one account in your single name, you will not be allowed to open a joint account as a primary accountholder.

- What happens if I close my OCBC 360 Account/-i before the interest/profit crediting date?

You will receive the prevailing Base Interest/Profit paid up to the day before the account closure. However, you will not be eligible for the Bonus Interest(s)/Profit(s).

- Do I need to "time" my eligible transactions?

Yes. There is occasionally a delay between when a transaction is performed by you, and when the transaction is posted to your account. Delays in the posting of transactions are due to various reasons, such as processing time, cut-off times, business days, etc. As such, only transactions that meet the qualifying criteria and are posted to your account within the month are counted towards payment of the Bonus Interest/Profit. The Bonus Interest/Profit will be paid out based on your average daily balance (up to a limit of RM100,000).

- How do I calculate the total interest/profit earned for a month?

You may refer to the Product Information Sheet for an illustration or use the Online Calculator; please also note the different calculation conventions between base interest/profit and bonus interest/profit (summarised in the table below).

| Type of Interest/Profit | Rate and computation | Remarks |

| Base interest/profit |

Accrued daily Sum of (daily end balance x applicable rate for the day) |

In the event of a rate hike or cut, the revised rate will be applied on the effective date. With this, the total Base Interest/Profit will be pro-rated. |

| Bonus Interest/Profit |

Calculated at month-end Average daily balance (ADB) x applicable interest/profit rate at month-end |

In the event of a rate hike or cut, the revised rate will be applied on the whole ADB amount of the month and the Bonus Interest/Profit is only calculated once at month-end. |