Your security matters to us

Do's

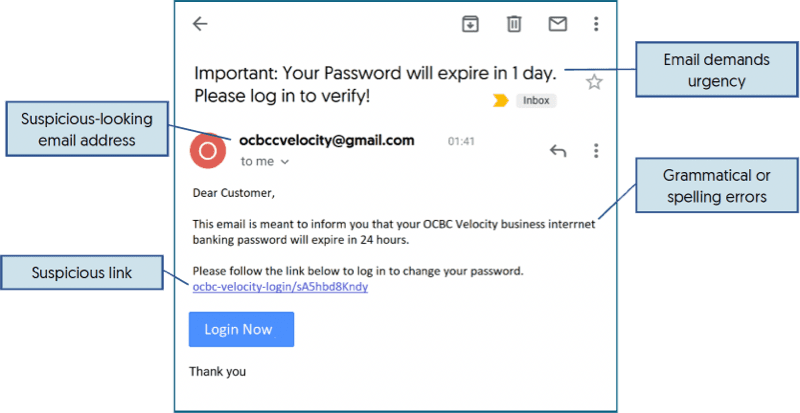

- Be wary of unsolicited requests by email, SMS or phone asking for personal or sensitive information, or that require you to log in and verify your account. Under no circumstances will the Bank ask you to reveal your PIN/Password.

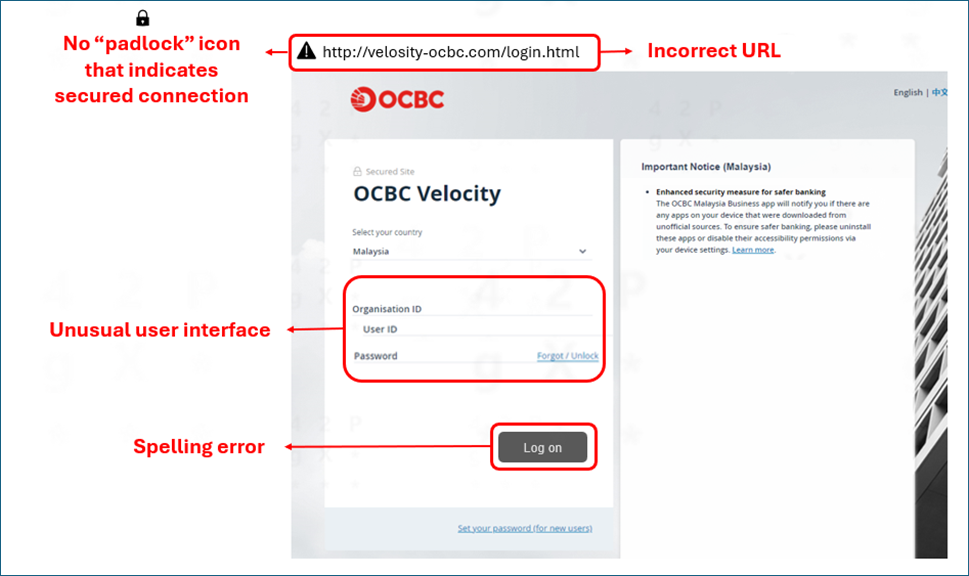

- Pay attention to the URL. Always key in the domain name of the Bank (correctly) into your browser when logging in to the Bank’s website.

- Keep your contact details up-to-date to receive SMS alerts or e-mail notifications for online banking transactions and activities.

- Check your bank account balances and transactions frequently. Inform the Bank if you are aware of any suspected fraudulent activity, or if you notice any unusual/unauthorised transactions.

- Be wary of unsolicited requests by email, SMS or phone asking for personal or sensitive information, or that require you to log in and verify your account. Under no circumstances will the Bank ask you to reveal your PIN/Password.

- Pay attention to the URL. Always key in the domain name of the Bank (correctly) into your browser when logging in to the Bank’s website.

- Keep your contact details up-to-date to receive SMS alerts or e-mail notifications for online banking transactions and activities.

- Check your bank account balances and transactions frequently. Inform the Bank if you are aware of any suspected fraudulent activity, or if you notice any unusual/unauthorised transactions.

Don'ts

- Do not share your password, PIN and One-Time-Password (OTPs) with anyone.

- Do not display your account information in a manner that is visible to others. Your device should never be left unattended.

- Do not accept links or redirections from other websites or media for the purpose of logging into your OCBC Velocity account.

- Do not click on hyperlinks or attachments provided in emails or mobile messages, such as by SMS or WhatsApp, from suspicious or unknown sources.

- Do not share your password, PIN and One-Time-Password (OTPs) with anyone.

- Do not display your account information in a manner that is visible to others. Your device should never be left unattended.

- Do not accept links or redirections from other websites or media for the purpose of logging into your OCBC Velocity account.

- Do not click on hyperlinks or attachments provided in emails or mobile messages, such as by SMS or WhatsApp, from suspicious or unknown sources.

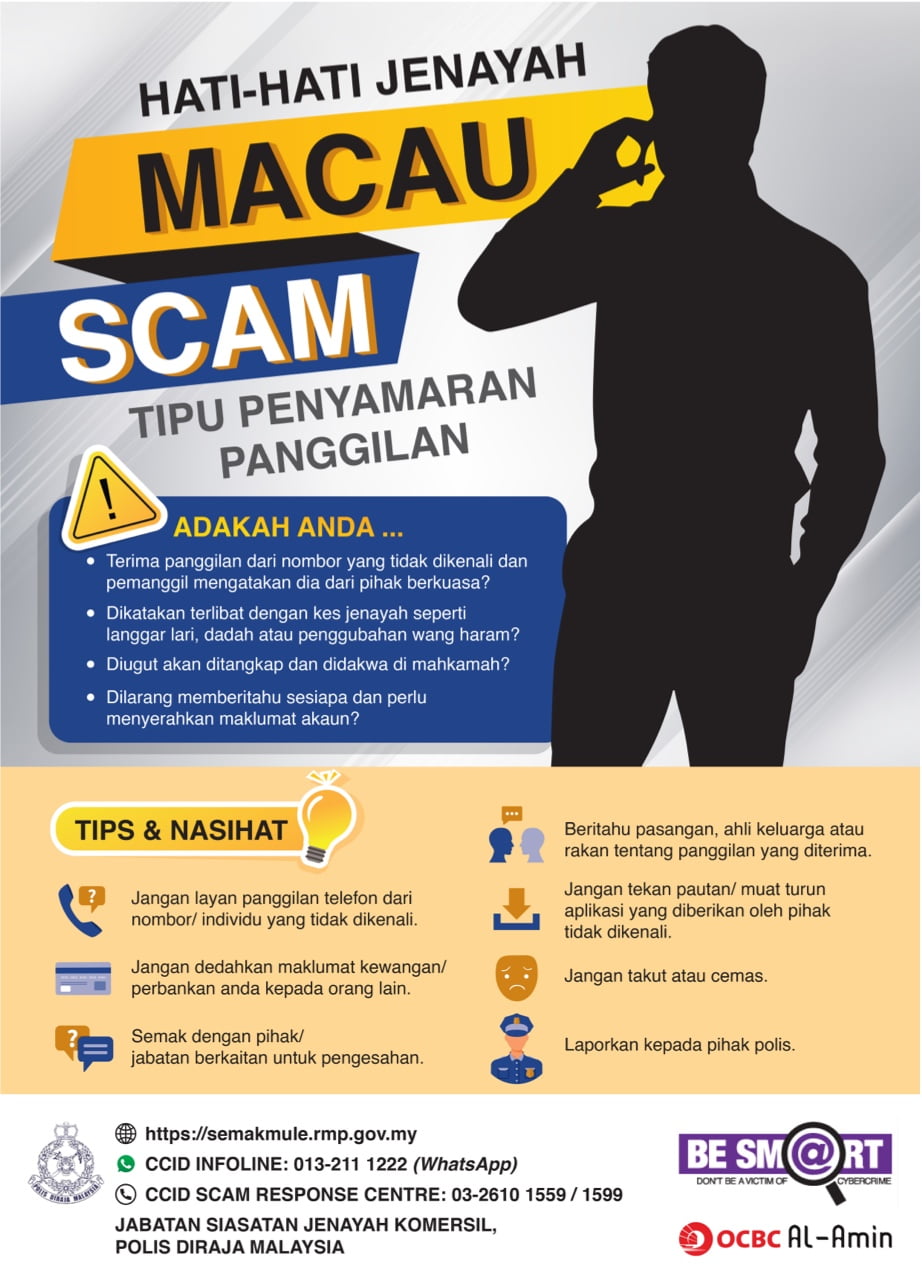

Phone Scams

Deceptive phone calls attempting to acquire your banking credentials.

What is an impersonation scam call?

An impersonation scam focuses on tricking users into believe something is true through seemingly legitimate interactive automated voice messages. Victims receive calls/interactive voice messages from fraudsters impersonating representatives or officers from courier companies, banks, customs officers, the police, or government bodies.

Popular types of phone scam

|

1

|

Macau scam |

|---|---|

| The scammer disguises himself or herself as a representative of a government body or legitimate institution. The person then claims that the victim has outstanding loan payments or unpaid fines. The victim will later be asked to transfer funds to avoid penalties or lawsuits. | |

|

2

|

Parcel scam |

| The scammer claims to be calling from a courier company or the customs office, informing the victim that he or she has unclaimed packages or parcels that are being held back because they contains illegal items. The victim is then requested to transfer funds to release the parcel and avoid detention by the authorities. | |

|

3

|

e-Commerce scam |

| The scammer entices the buyer to purchase products with fantastic deals and later asks for further payments for things like a delivery fee, insurance cost coverage or customs taxes to claim the product. Once the payments are made, the scammer will become uncontactable. | |

|

4

|

Phishing call |

| The scammer tricks the victim into entering a phishing website resembling their online banking website and then invites them to change their password or transfer money. Your banking credentials will be stolen once you log in to the phishing site. |

Some common signs of scam call

- Suspicious phone number.

- Delayed greeting or the use of automated voice response.

- The call comes from companies or government bodies with whom you do not have an association.

- You are invited to identify yourself by revealing personal or banking information.

- The caller tries to make you panic or rush you into decisions.

- The caller offers promotions or gifts that sound too good to be true.

What you should do if you receive a scam call

When in doubt, just hang up!

Do not share your internet banking credentials (passwords, PIN and One-Time-Passwords (OTPs)) to anyone or display the information in a manner that is visible to others.

Please be reminded that the Bank or government officials will not make unsolicited requests for your sensitive information through email or by phone.

If you have accidentally disclosed any personal or banking information to a suspicious caller or if you notice any unusual or unauthorised transactions, please call us immediately at 603-8317 5200.

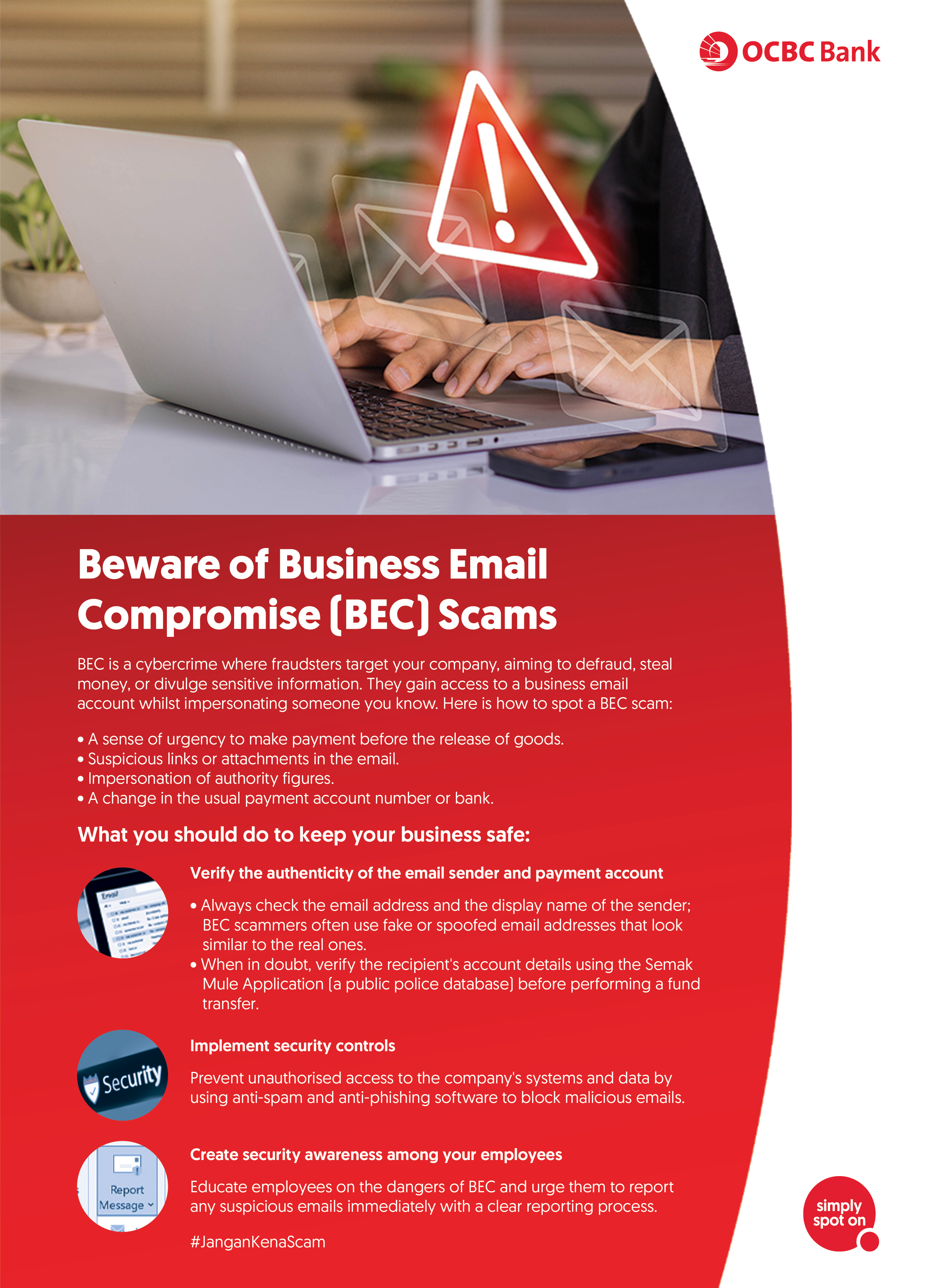

Business email compromise scams

Deceptive emails designed to trick you into transferring payment to a fraudulent bank account.

What is a business email compromise scam?

A fraudster may impersonate a senior executive or business partner using a similar or hacked email address to ask for payments to be directed to a new bank account under their control; or to steal critical business information for future attacks.

Safeguard yourself and your business from this scam

As a business owner

|

As an employee

|

If you have accidentally disclosed personal or banking information to a suspicious caller or if you notice unusual or unauthorised transactions, please call us immediately at 603-8317 5200.

Besides calling the Bank, you can also perform self-service per below under such circumstances:

- Suspend your access temporarily to OCBC Velocity.

- Reset your OCBC Velocity password.

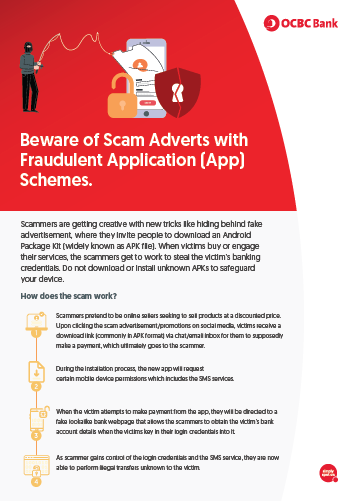

Malware

Intercepts communications between your browser and the Bank, it picks up sensitive or personal information such as your password and login ID.

How malware works

|

1

|

2

|

3

|

| Hackers send phishing emails with hyperlinks or attachments that appear to originate from trusted sources. | Malware will be downloaded onto the user’s device once the link/attachment is opened. | The installed malware will search and intercept files/online banking activities, maliciously stealing your banking credentials. |

Common types of malware

- Virus

Viruses can spread across devices and execute its own code to steal sensitive information. They can corrupt files through fake pop-ups that lure a person to visit unusual sites. - Ransomware

Computers infected with ransomware will result in restricted access until a ransom is paid. - Trickbot

Once your computer is infected, trickbot intercepts your communication with the internet banking site. Fake screens and pop-ups will appear to lure you into entering your login credentials. - Spyware

Spyware maliciously watches and monitors user activity and harvests confidential data without their knowledge.

How to tell if your devices have been infected

- The URL or screen shown on the login page is different from the official page: https://velocity.ocbc.com/login.html.

- You are repeatedly prompted to key in your login credentials even after you have entered it correctly.

- Suspicious account activities where you receive SMSes and OTPs for transactions you did not perform.

- You receive excessive pop-up messages or redirection to third-party websites.

How to protect yourself

- Key in the domain name of the bank in your browser to log onto OCBC Velocity rather than copying and pasting or via a pre-existing link.

- Install and maintain the latest anti-virus software.

- Do not open any unsolicited email or email from suspicious sources.

- Do not use public computers or connect to unsecure or publicly available WiFi to perform online banking activities.

- Do not install software or run programmes of unknown origin.

We would like to assure you that our OCBC Velocity is secure. As malicious software is constantly evolving, we strongly recommend that payment makers and authorisers always stay vigilant and verify the authenticity of all outgoing payment instructions, on top of scanning your devices for potential attacks regularly.

If you notice any unusual or unauthorised transactions that you did not initiate, please inform us immediately by calling 603-8317 5200.

How malware works

Hackers send phishing emails with hyperlinks or attachments that appear to originate from trusted sources.

Malware will be downloaded onto the user’s device once the link/attachment is opened.

The installed malware will search and intercept files/online banking activities, maliciously stealing your banking credentials.

Common types of malware

- Virus

Viruses can spread across devices and execute its own code to steal sensitive information. They can corrupt files through fake pop-ups that lure a person to visit unusual sites. - Ransomware

Computers infected with ransomware will result in restricted access until a ransom is paid. - Trickbot

Once your computer is infected, trickbot intercepts your communication with the internet banking site. Fake screens and pop-ups will appear to lure you into entering your login credentials. - Spyware

Spyware maliciously watches and monitors user activity and harvests confidential data without their knowledge.

How to tell if your devices have been infected

- The URL or screen shown on the login page is different from the official page: https://velocity.ocbc.com/login.html.

- You are repeatedly prompted to key in your login credentials even after you have entered it correctly.

- Suspicious account activities where you receive SMSes and OTPs for transactions you did not perform.

- You receive excessive pop-up messages or redirection to third-party websites.

How to protect yourself

- Key in the domain name of the bank in your browser to log onto OCBC Velocity rather than copying and pasting or via a pre-existing link.

- Install and maintain the latest anti-virus software.

- Do not open any unsolicited email or email from suspicious sources.

- Do not use public computers or connect to unsecure or publicly available WiFi to perform online banking activities.

- Do not install software or run programmes of unknown origin.

We would like to assure you that our OCBC Velocity is secure. As malicious software is constantly evolving, we strongly recommend that payment makers and authorisers always stay vigilant and verify the authenticity of all outgoing payment instructions, on top of scanning your devices for potential attacks regularly.

If you notice any unusual or unauthorised transactions that you did not initiate, please inform us immediately by calling 603-8317 5200.

Watch our public community webinar series to learn how you can be safe and smart against any potential frauds and scams.

Impersonation Scam

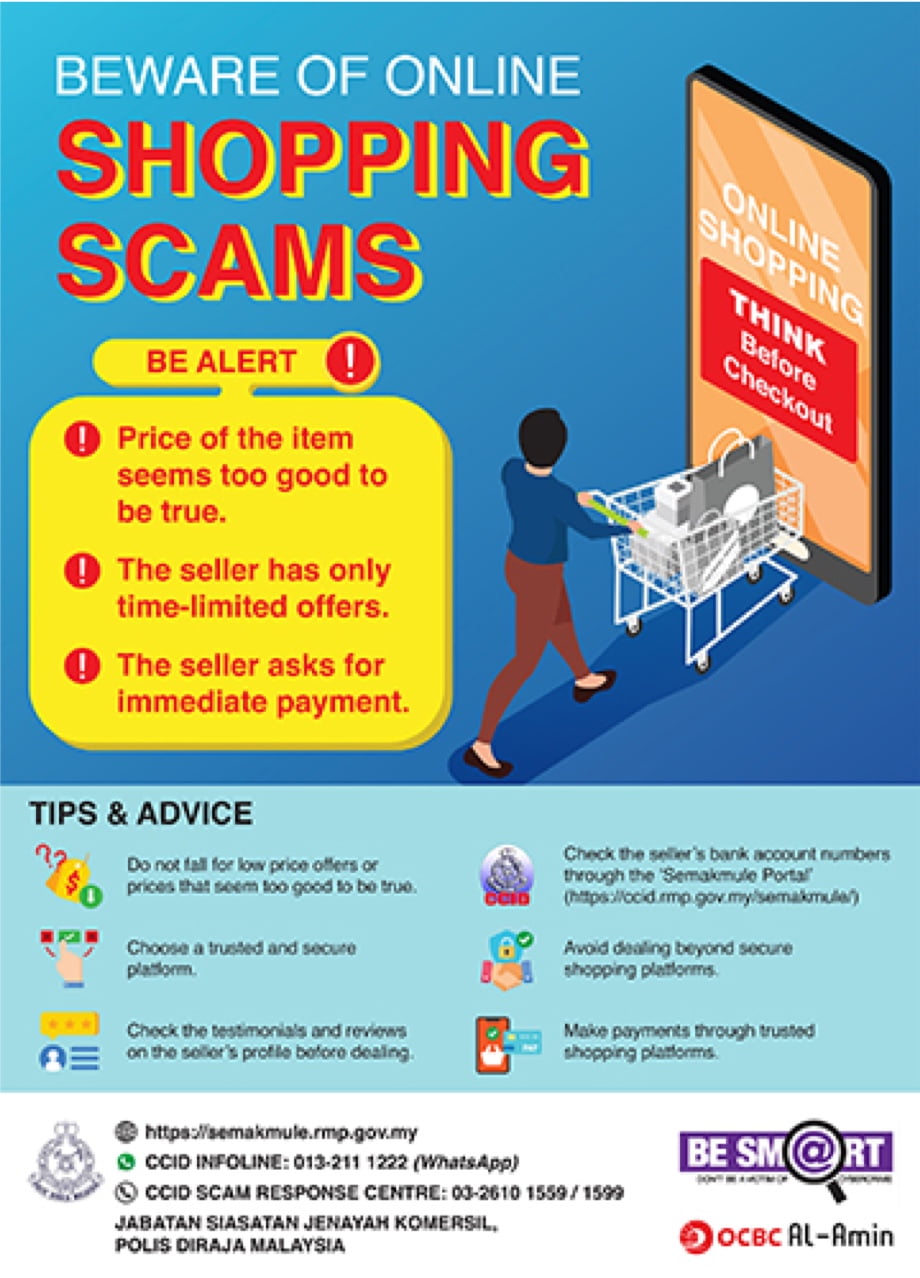

Online Shopping Scam

Investment Scam

Business Email Compromise Scam

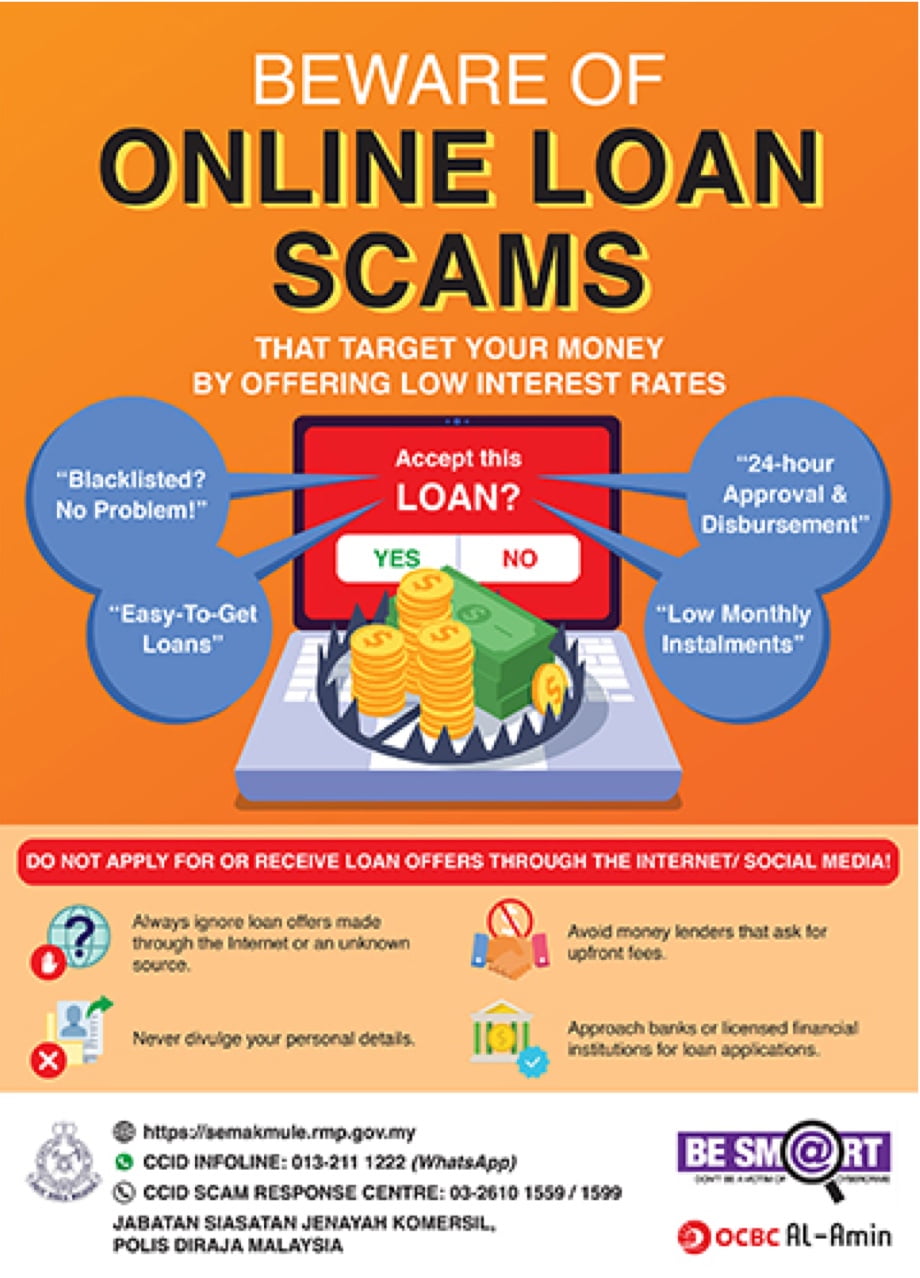

Illegal Loan Scam

Don't be fooled by these scams! Find out how else you can keep yourself and your loved ones financially and emotionally safe from scams.

SCAM! Hati-hati apabila menerima SMS

Jangan tekan pautan yang mencurigakan dalam SMS.

Panggilan Scam! Jangan jadi mangsa

Jangan panik ketika menerima panggilan daripada orang yang tidak dikenali.

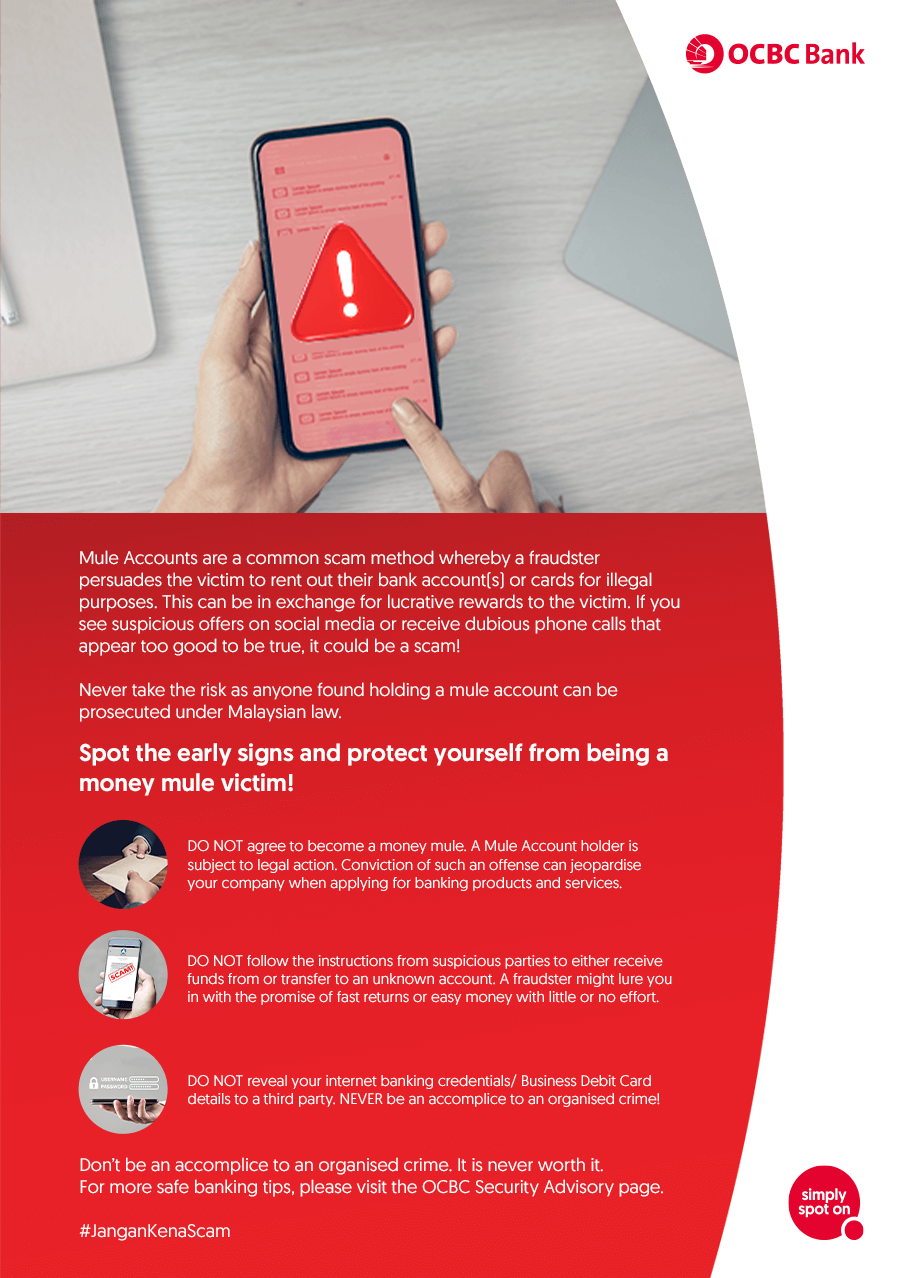

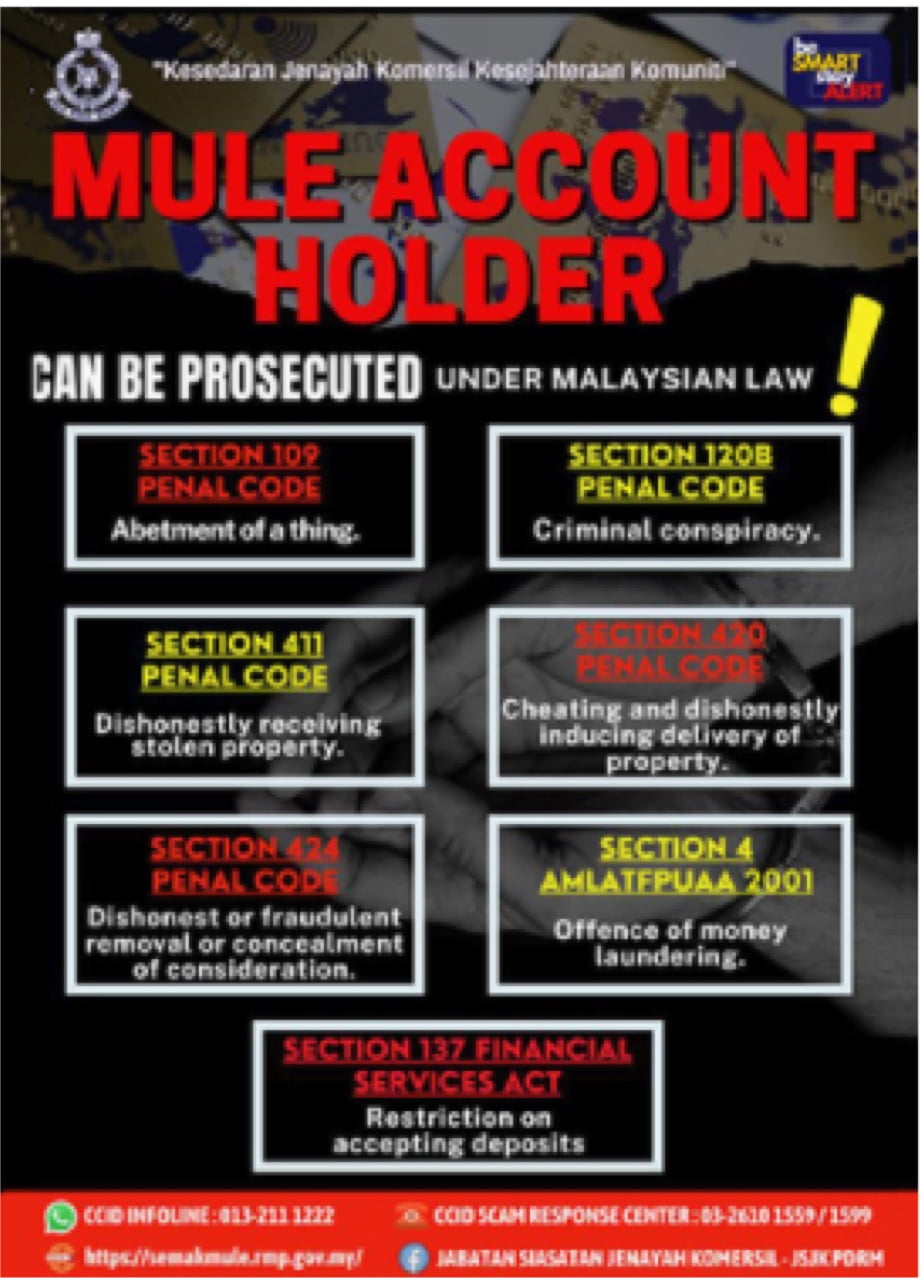

Jangan menjadi mangsa Keldai Akaun

Jangan meminjamkan, berkongsi atau menyewakan bank akuan anda.

Let us know your security concerns

Call us at 1300 88 7000 (within Malaysia) or +603 8317 5200 (outside Malaysia).

Let us know your security concerns

Call us at 1300 88 7000 (within Malaysia) or +603 8317 5200 (outside Malaysia).

SCAM! Hati-hati apabila menerima SMS

Jangan tekan pautan yang mencurigakan dalam SMS.

Panggilan Scam! Jangan jadi mangsa

Jangan panik ketika menerima panggilan daripada orang yang tidak dikenali.

Jangan jadi mangsa Keldai Akaun

Jangan meminjamkan, berkongsi atau menyewakan bank akaun anda.