-

How do I qualify for the wealth bonus?

You need to invest in any eligible wealth product of at least the minimum amount with OCBC Bank. Only purchases made from 18 December 2020 onwards will be eligible.

Note: To ensure that the product you purchase meets your financial needs, our Relationship Manager will perform a Financial Needs Analysis with you in order to help you make an informed decision.

-

When will I receive the wealth bonus?

Payment starts the following month after either (i) the free look/cancellation period ends; or (ii) 14 days after the effective date of purchase, whichever is later. Effective date of purchase refers to the inception date of the insurance product and trade date of Unit Trust.

For Example:

| Effective Date of purchase |

Date after free look/cancellation period or 14 days after Effective Date of purchase |

First month of wealth bonus |

| 1 January |

15 January |

January (Wealth bonus will be credited in February) |

| 20 January |

3 February |

February (Wealth bonus will be credited in March) |

-

How will I know that the base interest is credited to my OCBC Premier Booster Account?

Your base interest will be reflected in your Premier Wealth Report, Online Banking and Mobile Banking transaction history as INTEREST CREDIT.

-

How will I know that the wealth bonus is credited to my OCBC Premier Booster Account?

Your wealth bonus will be reflected in your Premier Wealth Report, Online Banking and Mobile Banking transaction history as WEALTH BONUS.

If you close your account before the wealth bonus crediting date, the wealth bonus for the previous month will be forfeited.

-

Can I combine multiple wealth product purchases of the same type to qualify for the wealth bonus?

Yes, you can, provided that you fulfil the conditions below:

(i) Effective dates of the purchases after the free look/cancellation period end or 14 days whichever is later must fall in the same calendar month. For example,

5 January 2021

RM5,000 lump sum investment in Unit Trust in Fund A with 2.75% sales charge |

19 January 2021 |

RM20,000 lump sum Unit Trust investment with 2.75% sales charge |

Yes

Effective dates for both purchases after cancellation period or 14 days whichever later, fall in the same calendar month. |

First RM50,000 average daily balance |

15 January 2021

RM15,000 lump sum investment in Unit Trust Fund B with 2.75% sales charge |

29 January 2021 |

5 January 2021

RM5,000 lump sum investment in Unit Trust in Fund A with 2.75% sales charge |

19 January 2021 |

RM20,000 lump sum Unit Trust investment with 2.75% sales charge |

No

Effective dates for both purchases after cancellation period or 14 days whichever later, do not fall in the same calendar month. |

Not applicable |

28 January 2021

RM15,000 lump sum investment in Unit Trust Fund B with 2.75% sales charge |

11 February 2021 |

(ii) Purchases of the same wealth product meeting the minimum eligibility criteria. For example,

5 January 2021

RM50,000 lump sum investment in Fund A with 2.25% sales charge |

RM80,000 lump sum Unit Trust investment with 2.25% sales charge |

Yes |

First RM200,000 average daily balance |

15 January 2021

RM30,000 lump sum investment in Fund B with 2.25% sales charge |

5 January 2020

RM6,000 Regular Premium Endowment Plan A |

RM 20,000 first year annual premium |

Yes |

First RM200,000 average daily balance |

15 January 2020

RM14,000 Regular Premium Endowment Plan B |

5 January 2020

RM100,000 Single Premium Plan A |

RM200,000 single premium |

Yes |

First RM500,000 average daily balance |

15 January 2020

RM100,000 Single Premium Plan B |

Examples of purchases which involve different sales charge or wealth products:

5 January 2021

RM70,000 lump sum investment in Fund A with 2.25% sales charge |

RM85,000 lump sum Unit Trust investment with different sales charge |

Yes

Both purchases in total fulfilled the minimum eligible criteria of RM80k with min sales charge 2.25%. |

First RM200,000 average daily balance |

15 January 2021

RM15,000 lump sum investment in Fund B with 2.75% sales charge |

5 January 2021

RM150,000 lump sum investment in Fund A with 2.25% sales charge |

RM290,000 lump sum Unit Trust investment with different sales charge |

Yes

Both purchases in total fulfilled the minimum eligible criteria of RM200k with min sales charge 2.25%. |

First RM500,000 average daily balance |

15 January 2021

RM140,000 lump sum investment in Fund B with 2.75% sales charge |

5 January 2021

RM10,000 lump sum investment in Fund A with 2.25% sales charge |

RM25,000 lump sum Unit Trust investment with different sales charge |

No

Sales charge for Fund A must be a minimum of 2.75% to be recognised as total eligible investment. |

Not applicable |

15 January 2021

RM15,000 lump sum investment in Fund B with 2.75% sales charge |

5 January 2021

RM2,000 Regular Premium Endowment Plan A |

RM7,000 combination total wealth products |

No

Each wealth product purchased does not meet the minimum eligibility criteria. |

Not applicable |

15 January 2021

RM5,000 lump sum investment in Fund B with 2.75% sales charge |

-

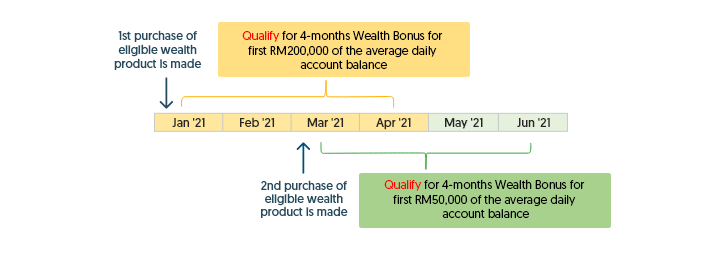

What happens if I qualify for the wealth bonus more than once and the bonus periods overlap?

If you make multiple purchases of eligible wealth products and qualify for wealth bonus more than once, for months which different bonus periods overlap, only one wealth bonus will be accorded and the bonus period with a higher bonus amount will be accorded.

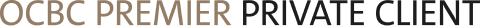

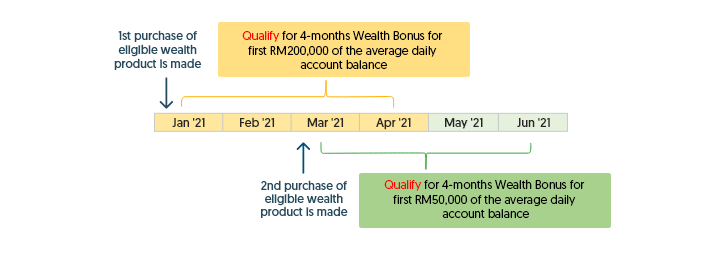

Example 1

| Effective Date |

Wealth Purchases |

Wealth Bonus is applicable to these: |

| 1 January 2021 |

RM20,000 lump sum investment in Fund A with 2.75% sales charge |

First RM50,000 average daily balance from January to April 2021 |

| 3 March 2021 |

RM100,000 Single Premium Plan B |

First RM200,000 average daily balance from March to June 2021 |

For the overlapping months (March - June 2021), you will enjoy a maximum wealth bonus of 1.20% per year for the bonus period which accord the higher bonus amount, i.e for the first RM200,000. You may refer to the illustration below.

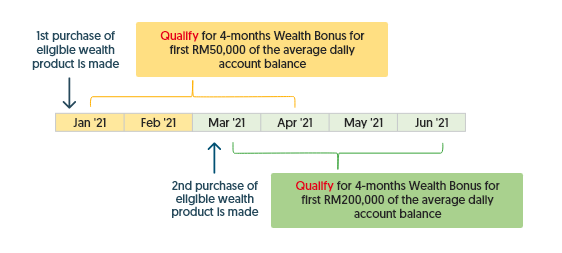

Example 2

| Effective Date |

Wealth Purchases |

Wealth Bonus is applicable to these: |

| 1 January 2021 |

RM20,000 lump sum investment in Fund A with 2.75% sales charge |

RM200,000 average daily account balance for 4 months from January 2021 to April 2021 |

| 3 March 2021 |

RM100,000 Single Premium Plan B |

First RM50,000 average daily account balance for 4 months from March 2021 to June 2021 |

For the overlapping months (March 2021 to April 2021), you will enjoy maximum wealth bonus of 1.20% per year for the bonus period which accord higher bonus amount, i.e. for the first RM200,000 of the average daily account balance. Thereafter, you will continue to enjoy the maximum wealth bonus of 1.20% for the bonus amount on the first RM50,000 of the average daily account balance. You may refer to the illustration below.

-

Will all my subsequent payments of regular premium eligible for wealth bonus?

Only your first year annual premium is eligible for wealth bonus.

-

How long can I enjoy the wealth bonus for if I qualify for it?

As long as you have purchased an eligible wealth product with an effective date of purchase after either (i) the free-look/cancellation period ends; or (ii) 14 days whichever later, you will enjoy the wealth bonus according to the predetermined period below:

| Eligible wealth product |

Wealth bonus earned |

| Regular/Single premium insurance |

4 months for eligible wealth products purchased from 18 December 2020 onwards |

| Unit Trust lump sum investment |

|

-

Do I continue to get this wealth bonus if I redeem my investments or when they mature?

Yes. You will continue to get this wealth bonus.

-

Do I continue to get this wealth bonus if I cancel my investment and/or policy during the free -look/ cancellation period?

No, you will not be eligible for the wealth bonus. The wealth bonus is accorded for only after either (i) the free look/cancellation period ends; or (ii) 14 days after the effective date of purchase, whichever is later.

-

How can I pay for the eligible wealth products?

There are many ways to pay for eligible wealth products:

Insurance: Cash, credit card or Auto Debit (via OCBC account)

Unit Trust (lump sum investment): Cash, Auto Debit (via OCBC account) or EPF account for applicable funds

-

Where can I find more information on the eligible wealth products?

For insurance, please click here.

For Unit Trust, please click here.

Alternatively, please leave your contact details here and we will get in touch with you.

-

What are the financial products excluded from wealth bonus?

These are examples of financial products that do not qualify for wealth bonus:

Dual Currency Investment (DCI)

Financing Facility

Foreign Exchange (FX)

Retail Bonds

Structured Investments

General insurance

OCBC Stabiliser or ARIP-i

Takaful term plans

-

If I have multiple Premier Booster accounts, which account will my wealth bonus be paid to?

The wealth bonus will be paid to the account with the higher bonus amount. In the event the wealth bonus amount is the same for several accounts, then the wealth bonus will be paid to the account with the largest account number.