OCBC Life Goals

EN | CN

Retirement Goal Calculator

Nobody can predict the future, but you can best prepare for it with OCBC Life Goals.

Your Retirement Plan

Understanding your retirement

Unable to show your retirement goal result.

There seems to be an invalid information,

Click here to correct the error.

There seems to be an invalid information,

Click here to correct the error.

When you retire in 0 years time,

You will need to set aside RM0

Age 0

Retirement

Age 0

Today

Age 0

Life expectency

How much would I need to retire

Continue

Edit retirement plan

How was this calculated?

Close

- When you retire in 32 years time, based on inflation of 2.42%*, your future monthly expenses will likely be RM 20,490.

The following assumptions are used in the calculation of the Goal graph:

- General disclaimer: The Retirement Goal Calculator is designed to provide only a general illustration of the potential retirement cost. The amount shown includes the projected rate of return for variables such as inflation, investment growth and cash in hand. Actual numbers may vary depending on the economic conditions. The information and analysis provided by this calculator are based on various assumptions, which are subject to change at any time without notice. This does not provide any analysis on your financial position, investment objectives nor individual needs, and must not be regarded as any advice for your financial planning.

- *Inflation Rate: The inflation rate is based on a 5-year average of Malaysia CPI (Consumer Price Index), 2014-2018 (Source: WEO (World Economic Outlook Database April 2019), updated as at April 2019).

- Goal amount: This is the estimated amount required at the retirement age to achieve your goal. It is calculated based on inflation adjusted expenses at retirement.

What you have today

Assets set aside for retirement

AMOUNT

ESTIMATED PROFIT RATE

Unable to show your retirement goal result.

There seems to be an invalid information,

Click here to correct the error.

There seems to be an invalid information,

Click here to correct the error.

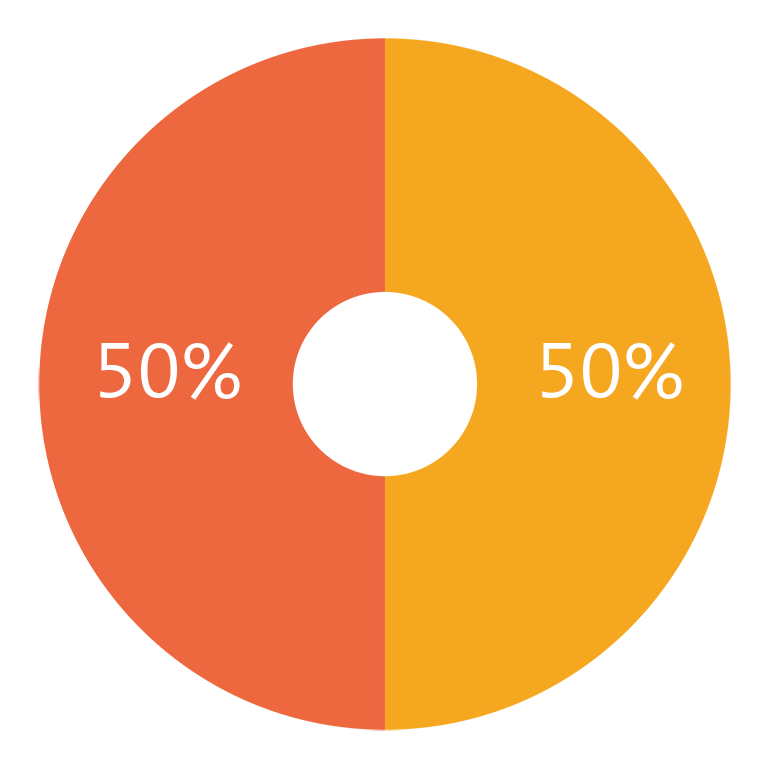

Based on your needs and assets,

You would have a of RM0

Your retirement goal

RM0

Your current assets

RM0

Your retirement goal

RM0

Projected value of assets

RM0

Estimated investment returns

RM0

Surplus

RM0

Shortfall

RM0

Show if I am ready to retire

Continue

Edit what I have today

How was this calculated?

Close

The following assumptions are used in the calculation of the Goal graph:

- General disclaimer: The Retirement Goal Calculator is designed to provide only a general illustration of the potential retirement cost. The amount shown includes the projected rate of return for variables such as inflation, investment growth and cash in hand. Actual numbers may vary depending on the economic conditions. The information and analysis provided by this calculator are based on various assumptions, which are subject to change at any time without notice. This does not provide any analysis on your financial position, investment objectives or individual needs as any advice for your financial planning.

- *Inflation Rate: The inflation rate is based on a 5-year average of Malaysia CPI (Consumer Price Index), 2014-2018 (Source: WEO (World Economic Outlook Database April 2019), updated as at April 2019).

- Goal amount: This is the estimated amount required at the retirement age to achieve your goal. It is calculated based on inflation adjusted expenses at retirement.

- Investment: All investments (Shares and Unit Trust/-i) are liquidated at start of retirement. The dividends are assumed to be re-invested.

- Projected value of savings/investments at retirement: This is the sum of projected values of current value of savings/investment set aside for this goal using the respective profit rate.

Investment approach(es) that best suits you

Choose ONE or BOTH approaches

In a disciplined manner

You prefer products such as endowment plan to help you grow your investment in a disciplined manner.

Tell us your preference

Return to top for this approach

To optimise returns

You prefer an investment portfolio that encompasses products such as unit trust/-i to provide you with potential capital and/or regular returns.

Tell us your preference

Return to top for this approach

Unable to show your retirement goal result.

There seems to be an invalid information,

Click here to correct the error.

There seems to be an invalid information,

Click here to correct the error.

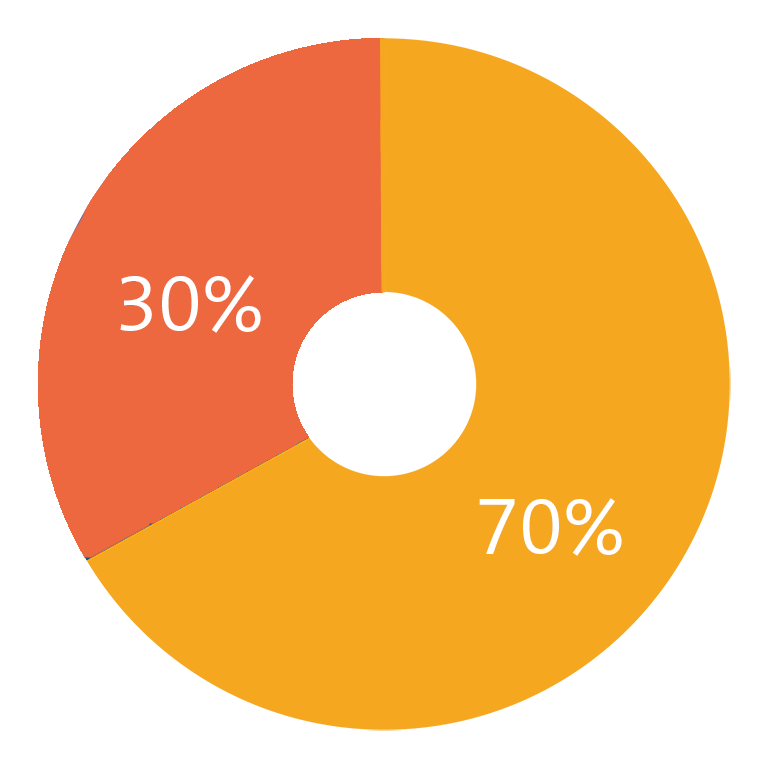

Based on your investment approach,

RM0

Your retirement goal

RM0

Your current assets

RM0

Your retirement goal

RM0

Projected value of assets

RM0

Estimated investment returns

RM0

Surplus

RM0

Shortfall

RM0

How would my choices help me

Continue

Edit my investment approach

How was this calculated?

Close

The following assumptions are used in the calculation of the Goal graph:

- General disclaimer: The Retirement Goal Calculator is designed to provide only a general illustration of the potential retirement cost. The amount shown includes the projected rate of return for variables such as inflation, investment growth and cash in hand. Actual numbers may vary depending on the economic conditions. The information and analysis provided by this calculator are based on various assumptions, which are subject to change at any time without notice. This does not provide any analysis on your financial position, investment objectives or individual needs, and must not be regarded as any advice for your financial planning.

- *Inflation Rate: The inflation rate is based on a 5-year average of Malaysia CPI (Consumer Price Index), 2014-2018 (Source: WEO (World Economic Outlook Database April 2019), updated as at April 2019).

- Goal amount: This is the estimated amount required at the retirement age to achieve your goal. It is calculated based on inflation adjusted expected expenses at retirement.

- Investment: All investments (Shares and Unit Trust/-i) are liquidated at start of retirement. The dividends are assumed to be re-invested.

- Current value of savings/investment: This is the sum of lump-sum cash, lump-sum investment set aside for this goal.

- Projected value of savings/investments at retirement: This is the sum of projected values of current and additional value of savings/investment set aside for this goal using the respective profit rate.

We have crafted options for your consideration based on your preferred investment approach.

Options for

disciplined manner approach

No options for disciplined manner approach

We apologies as we could not find a suitable option for this approach.

Options for

optimize returns approach

No options for optimize returns approach

We apologies as we could not find a suitable option for this approach.

To ensure that the investment products you purchase meet your financial needs, we will perform a Financial Needs Analysis with you to assess your invesment and risk appetite.

Put the investment approach into action

Let us help you with any enquiries you may have

Yes, let us assist you with it

No, email you this report