-

What is an OCBC Wealth Account?

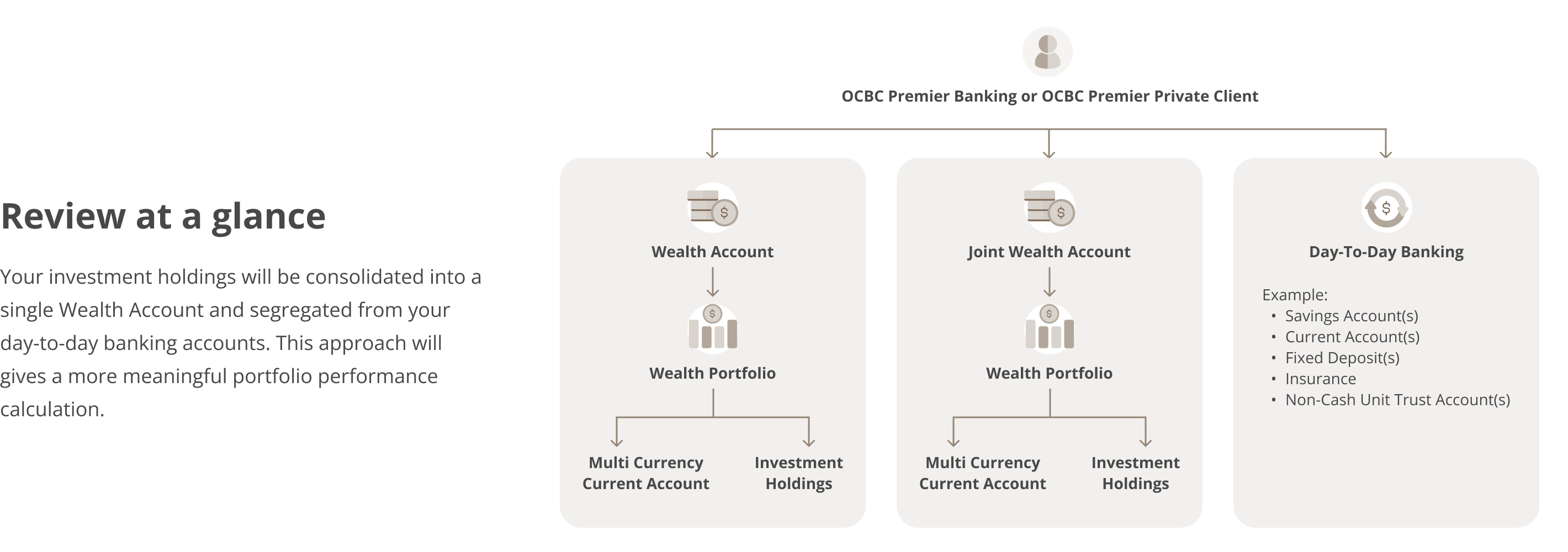

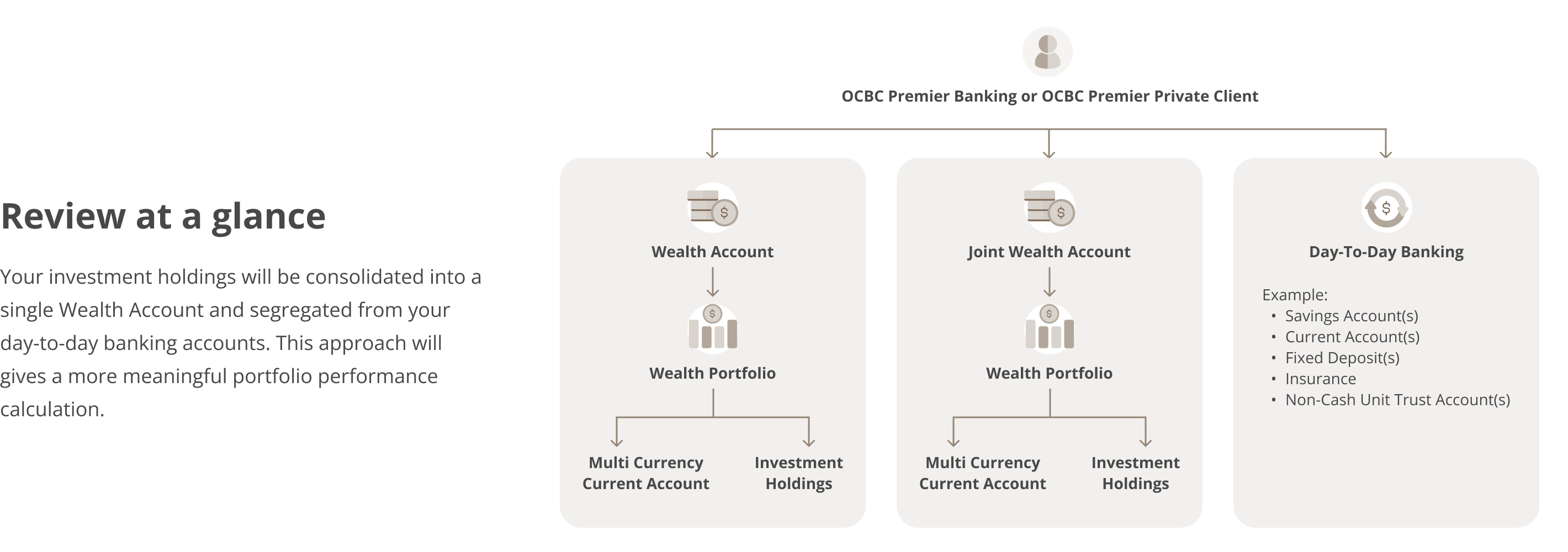

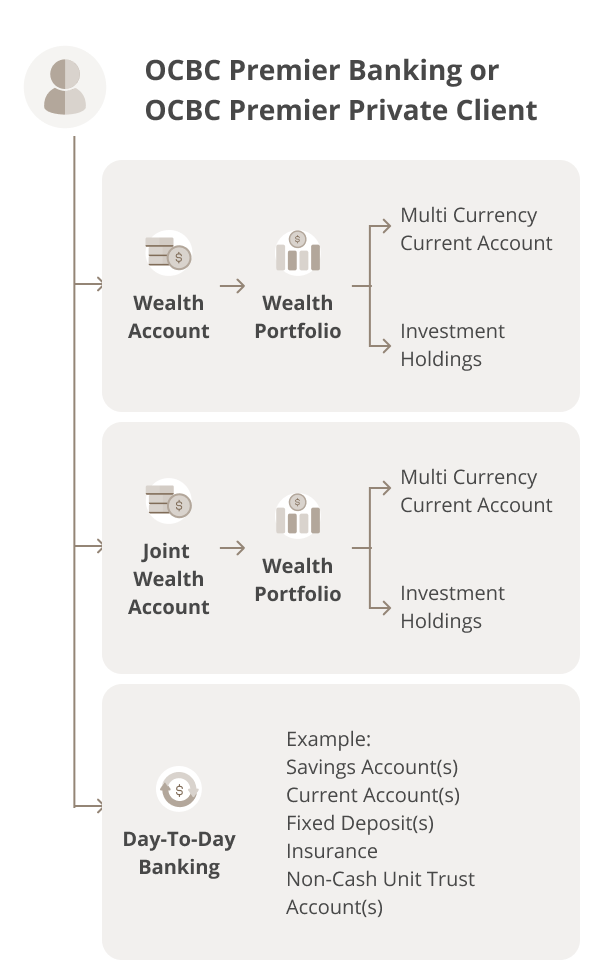

A Wealth Account is set up for the Customer who fulfils the criteria imposed by the Bank from time to time. A Wealth Account may be maintained and operated either in sole name (single person) or joint names (two or more persons). Each Wealth Account may consist of one or more Wealth Portfolios.

-

What is a Wealth Portfolio?

A Wealth Portfolio holds your investment products and comes with a Multi Currency Current Account as settlement account for your investment products. The investment products which will be held in the Wealth Portfolio include bonds, structured investments, negotiable instruments of deposit, cash funded conventional unit trust, etc. However, some investment products will not be held under the Wealth Portfolio, such as your regular investment plan Stabiliser / Arip-i, Islamic Unit Trust and non-cash funded Unit Trust (such as Unit Trust funded by EPF withdrawal).

-

What are the important changes to my existing wealth and investment holdings from 3 February 2022 that I should take note of?

The important changes that you should take note of are outlined below.

Arrangement under the OCBC Wealth Account

(on and after 3 February 2022)Existing Arrangement Management of Wealth Portfolio Signing authority for your investments The signing authority for your new Wealth Account(s) – and any Wealth Portfolios housed within it – will follow your preferred signing mandate selected for your Wealth Account(s). Each product account may differ in its signing authority. Asset classes that are now consolidated in your new Wealth Portfolio - Cash funded conventional unit trust

- Bonds (held in Bonds Custody Account)

- Structured Investments

- Dual Currency Investment

Investment assets are not consolidated – they are held in their respective product and custody accounts. Investment Activities and Transactions Proceeds of corporate actions, such as dividends and coupons Proceeds of corporate actions, such as dividends and coupon payments, will now be directed to the Wealth Portfolio that holds the relevant asset.

Should you depend on any existing incoming coupon or dividends for any payments, please ensure that you make alternative arrangements. Please reach out to your Relationship Manager or Client Advisor should you require assistance.

How you receive corporate actions, dividends and coupon payments depends on the standing instruction given when the respective product accounts were set up. Sale of marketable holdings The proceeds from such transactions will be delivered to the Wealth Portfolio that holds the relevant asset. The proceeds from such transactions are settled into your current/savings account on a trade-by-trade basis. Contract notes and transaction advices Contract notes and transaction advices will be delivered to you in the same way that your Wealth Report is delivered. You can view these documents by logging in to OCBC Internet/Mobile Banking. In addition, you will receive physical copies of these documents if you have opted to receive physical copies of your Wealth Report. Please note that for now, contract notes and trade advices are not included in the e-Statement service via email. Hard copies of the contract notes and transaction advices are delivered to the mailing address in our records. Wealth Financing and Deposits Wealth Financing Loan re/payment will be deducted from the Wealth Portfolio that supports the relevant loan. Loan interest re/payment is deducted from the account you indicated when you applied for the loan. Deposits Deposit interest, if any, will be credited to the Multi Currency Current Account within the Wealth Portfolio where the balances are held. Deposit interest, if any, will be credited to the Current/Savings Account where the balances are held -

What if I do not want to have access to a Wealth Account?

Please talk to your Relationship Manager or Client Advisor. They will share the options for your account.

-

In what scenario will I require an OCBC Wealth Account?

You will be required to have an OCBC Wealth Account if you have a OCBC Premier Banking or OCBC Premier Private Client banking relationship with us. This offering is part of our segment proposition. A banking relationship is determined by the segment status (e.g. Personal Banking, Premier Banking, Premier Private Client) of all account holders. An OCBC Wealth Account will be opened for you if you have an individual OCBC Premier Banking/OCBC Premier Private Client account or, if you have no individual account but have one or more joint accounts, all account holders are OCBC Premier Banking/OCBC Premier Private Client customers.

-

When will I receive my new Wealth Portfolio number?

You can obtain your wealth portfolio number(s) from:

- Your February 2022 Wealth Report

- Your Online Banking after 3 February 2022.

You can also reach out to your Relationship Manager or Client Advisor to obtain your Wealth Portfolio number(s).

-

How will my Wealth Portfolio number be derived?

The Wealth Portfolio number is system derived. This is an example of how your Wealth Portfolio number may look like: 6000000888-1

-

Will there be a system disruption to facilitate the creation of the Wealth Account?

Yes, there will be a disruption period on investment transactions from 27 to 31 January 2022. Please refer to below or contact your Relationship Manager or Client Advisor

No Products/Services Disruption period 1 Subscription, redemption, switching and transfer of unit trust 1 day

(31 January 2022)2 Buy, sell and transfer for retail bond 2 days

(28 and 31 January 2022)3 Subscription, rollover, top up amount and termination of Dual Currency Investment (DCI) 3 days

(27, 28 and 31 January 2022)4 Subscription, rollover and top up amount for Structured Investment (SI) or Negotiable Instrument of Deposit (NID) 1 day

(31 January 2022)5 Set up of financing facilities, drawdown, partial prepayment, full redemption and pledging of new collaterals 3 days

(27, 28 and 31 January 2022) -

What happens if I am no longer a Premier Banking or Premier Private Client member?

Your Wealth Account will be closed. Depending on your investment holdings, your Relationship Manager or Client Advisor will reach out to you to provide options on managing / operate your investments.

-

Will my investment accounts be closed after they are moved to the Wealth Account?

Selected investment accounts that have been moved will be closed, with the exception of Unit Trust and Retail Bond custody.

If your accounts no longer hold any investment positions after the migration of your assets to the Wealth Account, they will be phased out.

For more information, please contact your Relationship Manager or Client Advisor

-

Will my Wealth Account be reflected in my Wealth Report?

Yes, it will be reflected starting with your February Wealth Report.

However, any joint account holder who does not have Premier Banking or Premier Private Client membership during the upgrade will not be able to see this change reflected in their Wealth Report.

-

I am an OCBC Al-Amin Bank client. Will I be affected by this system upgrade?

At this point of time, Wealth Account is not available to OCBC Al-Amin Bank clients, so you will not be affected by this system upgrade.

OCBC Wealth ACCOUNT

Your assets. All in one place

Oversee your portfolio easily with OCBC Wealth Account

Managing an active investment portfolio can be challenging. That is why we have enhanced our wealth management platform so that you will have a holistic view of your wealth and be able to instantly track the performance of your investments. You will also be able to manage and review your cashflows and returns better.

To cater to the wealth platform upgrade effective 3 Feb 2022, the OCBC Premier Banking and OCBC Premier Private Client Terms and Conditions have been consolidated into one and named the OCBC Premier Banking and OCBC Premier Private Client Terms and Conditions.

The new Terms and Conditions will not change your current status as a client of OCBC Premier Banking or OCBC Premier Private Client.

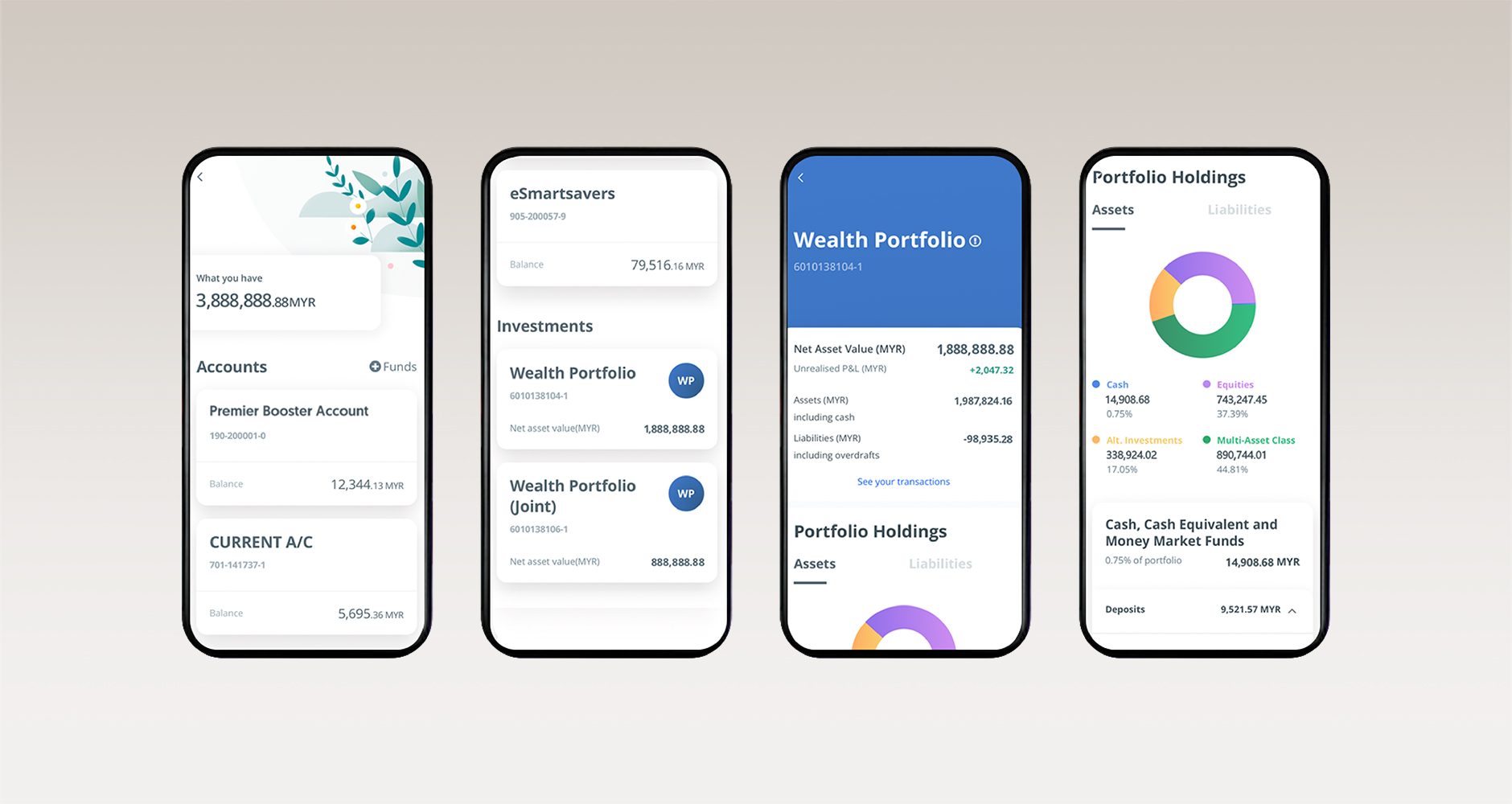

Track on-the-go

View your fund performances and contract notes online. This is how your OCBC Wealth Account will look like on the OCBC Malaysia Mobile Banking app.

Enjoy greater clarity

Your investments are categorised by their underlying assets instead of the investment product types.

Expanded suite of wealth products

Gain access to our extended range of products, like the Multi Currency Current Account and Multi Currency Term Deposit.

Multi Currency Current Account

Multi Currency Term Deposit

Bank from anywhere

Perform banking and investment transactions securely through phone without having to go to the bank or complete a form.

Find out more

Money Transfer feature allows you to transfer funds between your OCBC Wealth Account and your Savings, Current or Foreign Currency Accounts through the OCBC Malaysia Mobile Banking app.

Transfer funds instantly in 5 easy steps:

Wealth Report enhancements to provide greater clarity on your portfolio's performance

The enhanced Wealth Report now features your Wealth Portfolio under the new OCBC Wealth Account to make it easier for you to analyse the composition and performance of your investment holdings.

What's new:

- Your day-to-day banking holdings and transactions are now segregated from your investment holdings and returns

- Your Wealth Portfolio is now presented based on its Net Asset Value

- Your Wealth Portfolio holdings are now displayed according to a new Asset Classification Framework based on the underlying asset structure, with a revision to the naming convention for Structured Investments

Look forward to more updates from us on how you can better understand the benefits of your new Wealth Report. Stay tuned.

Maximise your asset value for greater flexibility

The assets in your portfolio will now be automatically pooled to enhance your wealth borrowing power.

By making full use of the value of your holdings with us, you can choose to reinvest them in our comprehensive suite of wealth products or divert them to key investment opportunities.

Reach out to your Relationship Manager or Client Advisor for more details.

Terms and conditions

Terms and conditions governing both OCBC Premier Banking and OCBC Premier Private Client.

PIDM disclosure

This deposit is protected by PIDM up to RM250,000 for each depositor. Learn more

- Deposit protection is automatic.

- PIDM protects depositors holding deposits with banks.

- There is no charge to depositors for deposit insurance protection.

- Should a bank fail, PIDM will promptly reimburse depositors over their deposits.

For more information, refer to PIDM's DIS Brochures that are available at our counters or go to the website at www.pidm.gov.my.

Give your wealth the distinct advantage

or visit us at an OCBC Premier Centre.

Common questions

-

What is a Multi Currency Current Account?

Multi Currency Current Account is a current account which serves as the settlement account for your investment products in the Wealth Portfolio. This means, for example, any dividend, income, proceed generated or arising from your investment products will be credited into this current account, and all sums, fees, charges payable for the investment products will be debited from this current account.

This Multi Currency Current Account is denominated in 10 major currencies which will facilitate settlement of investment products in multiple currencies. However, there are some restrictions in the operation of the Multi Currency Current Account. For more information of the terms and conditions of Multi Currency Current Account, please refer to the OCBC Premier Banking and OCBC Premier Private Client Terms and Conditions or view the Product Information Sheet.

-

Can I hold cash in the Wealth Account?

Yes, the monies held in the Multi Currency Current Account is your cash account.

-

What are the interest rates for cash held in the Multi Currency Current Account?

You may refer to our website for prevailing rates on your Multi Currency Current Account in the Wealth Portfolio.

-

What are the operational differences for the deposit services in the Wealth Portfolio and that in the day-to-day Current and Savings Account?

There will be no cheque book issued for your Multi Currency Current Account.

Additionally, all deposits into or withdrawals from your Multi Currency Current Account in the Wealth Account can only be made to or from your day-to-day Current and Savings Account. You may not deposit funds by transfer from another bank or by cash directly into your Multi Currency Current Account. Similarly, you may not withdraw from your Multi Currency Current Account to transfer to another bank or in the form of cash.

-

If I am a Malaysian resident, can I have a joint investment account with a non-resident individual? Also, will I be able to have access to different currencies under this jointly held Multi Currency Current Account?

A resident individual is allowed to open and maintain a foreign currency account jointly with a non-resident individual provided he or she is an immediate family member (FE Notices defines “immediate family members” as a legal spouse, parent, legitimate child (including legally adopted) or legitimate sibling of an Individual) of the resident individual. Otherwise, only the ringgit currency will be made available under the Multi Currency Current Account. Please refer to Bank Negara Malaysia’s Foreign Exchange Notices for details.

-

Can I place a Multi Currency Term Deposit in my Wealth Account? What are the rates?

Yes, only if you are granted Facilities (Overdraft and Revolving Credit) and you proffer cash to be placed in the Multi Currency Term Deposit as security for the Facilities. You may refer to our website for prevailing rates on Multi Currency Term Deposit in the Wealth Portfolio.

-

What are the operational differences in the Multi Currency Term Deposit in the Wealth Account and that in the day-to-day Fixed Deposit and Time Deposit Account?

All deposits into or withdrawals from your Multi Currency Term Deposit in the Wealth Portfolio can only be made to or from your Multi Currency Current Account.

Additionally, your MYR Multi Currency Term Deposit will not mature or renew on Saturdays, Sundays and Malaysia National Holidays.

Your other currency in the Multi Currency Term Deposits will not mature or renew on Saturdays, Sundays, Malaysia National Holidays, Kuala Lumpur Holidays (Headquarters’ Holidays) and respective currencies’ holidays. Instead, these Multi Currency Term Deposits will mature or renew on the next business day.

-

What happens to my existing incoming coupon / dividend payments?

For existing arrangements for any incoming payments arising to your investments, dividends will be paid to your Multi Currency Current Account in your Wealth Portfolio with effect from 3 February 2022. No action is required from you. Should you depend on any existing incoming coupon or dividends for any payments, please ensure that you make alternative arrangements. Please reach out to your Client Advisor / Relationship Manager should you require assistance.

-

If I have a coupon or dividend payment that is expected to be paid during the blackout period from 27 to 31 January 2022, what should I expect?

We will continue with crediting your coupon or dividend payments as scheduled to your Current / Savings Account as per your current Signed Standing Instruction. The investment asset however will be transferred to your Wealth Portfolio with effect from 3 February 2022.

Should you observe any discrepancy in this, please reach out to your Client Advisor / Relationship Manager.

-

What happens to outstanding orders, that have been booked but not yet filled?

For such transactions, the bank will perform an asset transfer into the Wealth Portfolio once the trade is settled after the platform upgrade. As a result, please note you may receive an Asset Transfer advice or see it reflected in your Wealth Report as an Asset Transfer movement.

-

What happens to my filled order that has not yet been settled prior to the upgrade of my account?

For such transactions, the bank will perform an asset transfer into the Wealth Portfolio once the trade is settled after the platform upgrade. As a result, please note you may receive an Asset Transfer advice or see it reflected in your Wealth Report as an Asset Transfer movement.

-

For trades going forward, what account number should I quote?

From 3 February 2022 onwards, you should quote your Wealth Portfolio number. Trades can only be settled to/from your Wealth Portfolio.

-

What will be the custodian arrangement like going forward?

There will be no change in the custodian arrangement after the system upgrade.

-

What will happen to my existing Wealth Report(s) and Contract Note(s) delivery arrangements?

There is no change to the delivery arrangements of your Wealth Report.

After the enhancement, contract notes and trade advices for investment transactions in your Wealth Portfolio will follow the delivery arrangements of your Wealth Report. This means that if you are receiving your Wealth Report electronically via OCBC Internet/Mobile Banking, you will receive your contract notes and trade advices via OCBC Internet/Mobile Banking from 3 February 2022, and hard copies will no longer be sent to your registered mailing address. Please note that for now, contract notes and trade advices are not included in the e-Statement service via email.

-

What is the new asset classification framework?

All investment products will be classified by their underlying assets. The greatest change will be marked in our classification of unit trusts, where the underlying asset of the unit trust will determine its grouping. For example, if you have a unit trust where the underlying asset features mostly Fixed Income assets, it will be reflected under the section on Fixed Income.

This approach will offer you better representation of your asset/investment allocation and risk management strategy.

For more information, you may reach out to your Client Advisor / Relationship Manager.

-

What are the currency options I have in the new Wealth Report?

The default reporting currency is MYR. However, you can choose to have your reporting currency in USD.

-

How do I read the new Wealth Report?

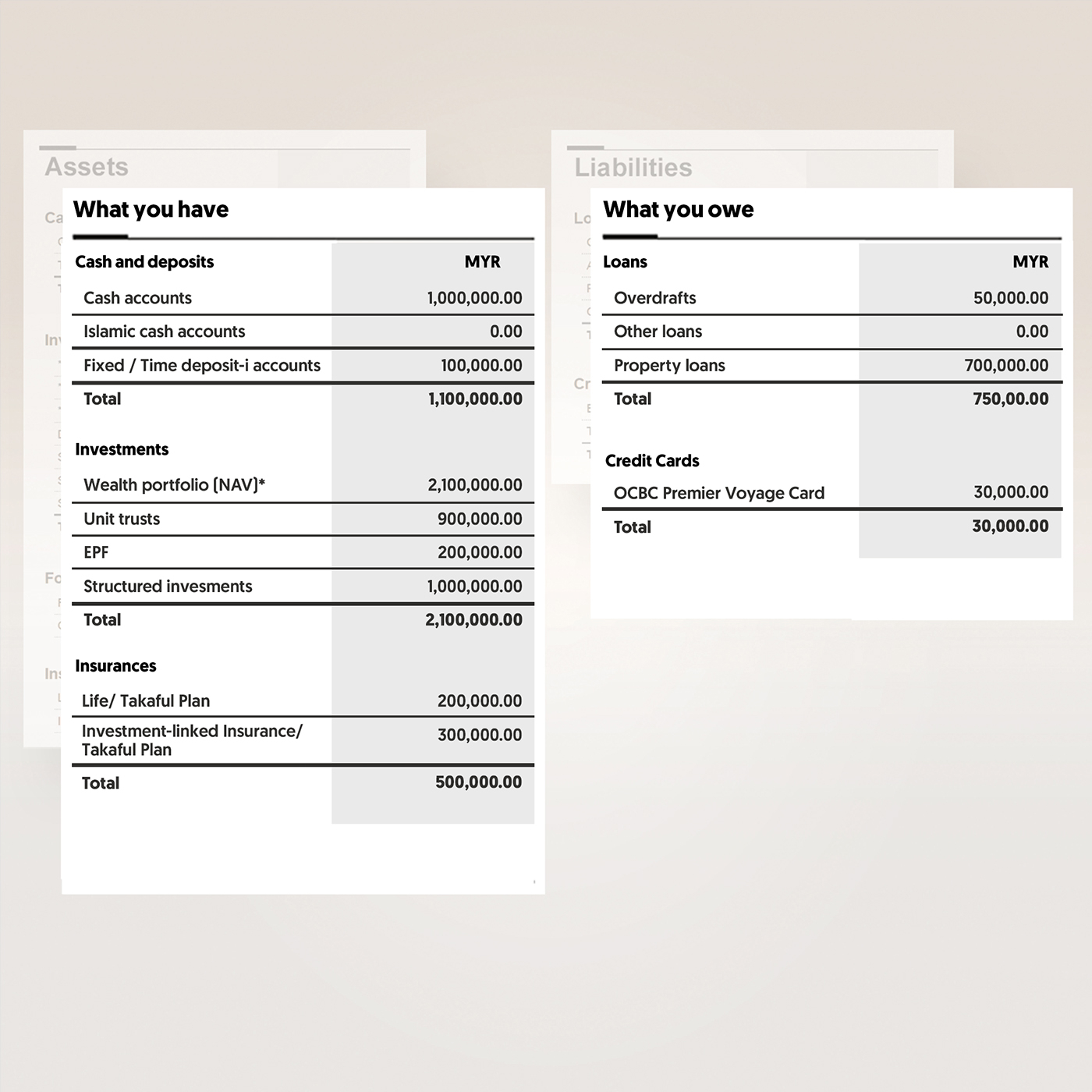

Your Wealth Report will showcase your assets and liabilities held in your day-to-day banking accounts and those within your Wealth Portfolio.

On the section covering your Wealth Portfolio, your investment assets will be organised by the underlying asset of the investment.

For example, if you have a unit trust where the underlying features mostly equity assets, it will be reflected under the section on Equities

-

What languages can my Monthly Wealth Report come in?

You can opt to have your Wealth Report to be accompanied by either Simplified Chinese Mandarin or Bahasa Malaysia, in addition to English.

-

Here are just some of the new features that you will enjoy:

- New wealth dashboards will show your indicative portfolio performance

- A consolidation of your wealth holdings in a single view

- A revamped menu for easy navigation

Trade confirmations and documents such as contract notes will be available for you to view online.

-

Can I transfer money into my OCBC Wealth Account directly via Internet Banking or Mobile Banking.

Transfer of funds into your Wealth Account from your existing OCBC current/savings account(s) will only be available via Mobile Banking, Branch or Contact Centre or through your Relationship Manager/Client Advisor. Transfers via Internet Banking will only be available and announced at a later stage.